At Paddle, we have 3000 software company clients facing into this environment.  For Chamath Palihapitiya, companies that can go dark (avoid investment) for 3-5 years can ride out the impending storm, but others will need to control their operations and profitability. That downward trajectory may continue even if the public markets stay flat at todays levels. How much incremental cash does that extra growth cost and where do the lines cross on a sufficient growth rate and rate of investment i.e. Explore Paddle's complete payments infrastructure for SaaS, How Paddle can help you from launch to exit, Insights and guides on growing a successful software business, How software businesses grow faster with Paddle, The latest SaaS insights, opinions, and talking points, Learn more about Paddle's products and services, Discover the most painful tax jurisdictions, Find answers to your questions about Paddle, Explore Paddle's APIs, webhooks, reference, and guides, See if everything is running as it should be, Request a refund or cancel a subscription, The metrics driving SaaS valuations in 2022, When investors care about total addressable market (TAM) and how to expand yours, Robust revenue infrastructure increases your SaaS company's valuation at every stage. Were not sure, but the following analysis looks at the trading trends of every public SaaS company over the past 20+ years to today (13-May-2022 - or until they were acquired) to get a sense of where companies could trade at a steady-state. Over 80% of companies in this index are now trading below 10x NTM (next twelve months) revenue, once deemed a historical terminal multiple for the best companies. Get from $0 to $100 Million in ARRwith less stress and more success. And indeed there is today! Improving retention: Overlooked optimizations such as involuntary churn and payment conversion rates are easy to deprioritize in good times, but they hurt burn rate and impact valuations. NetSuite was over $160M in implied ARR growing ~45% YoY at the end of 2008 before slowing dramatically. Let's use an example to make it easy to understand. Stack Overflow CTO: From bootstrapped to scaling one of the Web's biggest properties, Google CEO tells employees productivity and focus must improve, launches 'Simplicity Sprint' to gather employee feedback on efficiency, China's Former Richest Man Is Giving Up All His Power After His Mysterious Disappearance, Bad news, Amazon Prime members - one of your best perks is being taken away, For Notion, a downturn is time to play offense, Bikayis Disarray: Sequoia, YC-Backed Startup Hit By Fraud Allegations, Seller Exodus, Amazon sheds record 99k employees after overstaffing warehouses, will slow office hiring, Ex-NBA Star Metta World Peace Targets $1 Billion Investment Fund. The panel agreed that in a volatile market, public market investors are looking for high-quality and reliable companies with plenty of cash on the balance sheet; the must-own companies not the nice-to-own companies. So personally, I think this is the most likely scenario. Growth Adjusted Multiples (Enterprise Value / NTM Revenue divided by growth rate). Given all of these factors have hit the markets at once, we have seen historic drops in market value for public SaaS companies and they have in many ways reverted back to and in some cases below historical forward revenue multiples. The chart below looks at every pure-play SaaS company that has traded publicly (~90 companies today): the cumulative market capitalization reached over $2T in 2021 and is down ~$1T, or around ~50% from the highs (and that's including many new IPOs that have entered the index last year). The median has dropped 67% to $7.7B today. Healthy growth margins, healthy contribution margins, and a realistic path to profitability which means being EBITDA positive this year or within the next two years.. The year still ended strong, and the next 5 years went on to be the greatest growth tear SaaS has ever seen (2H16 to 2021). In 2016. The top SaaS and Cloud leaders are even accelerating at $1B in ARR, for goodness sakes!! SaaS companies are just so much stronger, faster growing, and enduring than before. So it cant all be about cash-flows.

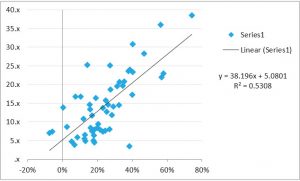

For Chamath Palihapitiya, companies that can go dark (avoid investment) for 3-5 years can ride out the impending storm, but others will need to control their operations and profitability. That downward trajectory may continue even if the public markets stay flat at todays levels. How much incremental cash does that extra growth cost and where do the lines cross on a sufficient growth rate and rate of investment i.e. Explore Paddle's complete payments infrastructure for SaaS, How Paddle can help you from launch to exit, Insights and guides on growing a successful software business, How software businesses grow faster with Paddle, The latest SaaS insights, opinions, and talking points, Learn more about Paddle's products and services, Discover the most painful tax jurisdictions, Find answers to your questions about Paddle, Explore Paddle's APIs, webhooks, reference, and guides, See if everything is running as it should be, Request a refund or cancel a subscription, The metrics driving SaaS valuations in 2022, When investors care about total addressable market (TAM) and how to expand yours, Robust revenue infrastructure increases your SaaS company's valuation at every stage. Were not sure, but the following analysis looks at the trading trends of every public SaaS company over the past 20+ years to today (13-May-2022 - or until they were acquired) to get a sense of where companies could trade at a steady-state. Over 80% of companies in this index are now trading below 10x NTM (next twelve months) revenue, once deemed a historical terminal multiple for the best companies. Get from $0 to $100 Million in ARRwith less stress and more success. And indeed there is today! Improving retention: Overlooked optimizations such as involuntary churn and payment conversion rates are easy to deprioritize in good times, but they hurt burn rate and impact valuations. NetSuite was over $160M in implied ARR growing ~45% YoY at the end of 2008 before slowing dramatically. Let's use an example to make it easy to understand. Stack Overflow CTO: From bootstrapped to scaling one of the Web's biggest properties, Google CEO tells employees productivity and focus must improve, launches 'Simplicity Sprint' to gather employee feedback on efficiency, China's Former Richest Man Is Giving Up All His Power After His Mysterious Disappearance, Bad news, Amazon Prime members - one of your best perks is being taken away, For Notion, a downturn is time to play offense, Bikayis Disarray: Sequoia, YC-Backed Startup Hit By Fraud Allegations, Seller Exodus, Amazon sheds record 99k employees after overstaffing warehouses, will slow office hiring, Ex-NBA Star Metta World Peace Targets $1 Billion Investment Fund. The panel agreed that in a volatile market, public market investors are looking for high-quality and reliable companies with plenty of cash on the balance sheet; the must-own companies not the nice-to-own companies. So personally, I think this is the most likely scenario. Growth Adjusted Multiples (Enterprise Value / NTM Revenue divided by growth rate). Given all of these factors have hit the markets at once, we have seen historic drops in market value for public SaaS companies and they have in many ways reverted back to and in some cases below historical forward revenue multiples. The chart below looks at every pure-play SaaS company that has traded publicly (~90 companies today): the cumulative market capitalization reached over $2T in 2021 and is down ~$1T, or around ~50% from the highs (and that's including many new IPOs that have entered the index last year). The median has dropped 67% to $7.7B today. Healthy growth margins, healthy contribution margins, and a realistic path to profitability which means being EBITDA positive this year or within the next two years.. The year still ended strong, and the next 5 years went on to be the greatest growth tear SaaS has ever seen (2H16 to 2021). In 2016. The top SaaS and Cloud leaders are even accelerating at $1B in ARR, for goodness sakes!! SaaS companies are just so much stronger, faster growing, and enduring than before. So it cant all be about cash-flows.  This post is divided into three sections: 1) the history of public trading performance and valuations for all public SaaS companies 2) case studies of Salesforce and NetSuite during the Great Recession and 3) a framework for thinking about operating plans, both the top and bottom line, in this new world. So the public markets are in tumult. Join over 5500+ like-minded B2B SaaS founders in our free Founder Community. Well explain these below. Update on cloud software multiples, charted alongside the 10Y and 5 year pre-covid NTM rev multiple average. According to David Sacks, in an up market or a boom market the three things that matter are growth, growth and growth. In a down market, the three things that matter are growth, burn, and margins. Sacks has been advising his portfolio to lengthen their cash runway to 2-4 years and be more capital efficient to avoid having to raise too quickly and face a potential down round, while also tempering fundraising expectations, stating that if you raised last year at 100 times ARR, you need to understand that the next time you raise it might be at 20 times ARR. For him, the key is a good Burn Multiple - ensuring you spend less than $2 for every $1 of incremental ARR that you generate - and prioritizing burn over growth at any cost. Here are three mistakes that you should avoid. Its been a rough day and 6 months in public tech land. This could have an even bigger impact on valuations if the fundamentals of businesses change for the worse. But what if you traded at 50x forward revenue and are now trading at 10x, and your associated forward revenue also dips by 30-40-50% from your prior plan? With the current public SaaS universe trading at a median 7.1x NTM revenue multiple, and looking back at the Great Recession lows of companies like NetSuite and Salesforce, which were the best companies at the time, there could be more declines given these businesses were trading at ~1-2x NTM revenue during their lowest points. Is your burn multiple under 2? saw during lockdown, we should still end up somewhere in the middle. The following charts show, for the 25 companies that are currently growing LTM revenue the fastest (around 50% or more), a comparison over the past 12 months of their peak multiples and market caps vs. where they are trading today (and just how far theyve dropped). SOM (or, serviceable obtainable market) looks at how much of the market you can feasibly capture. But they did survive to achieve that eventual increase in value. SaaS valuation is based on future growth, so if a market is already tapped out, this can impact exit prices significantly. burn. Raising rates is one of the last tools the Fed has to fight inflation. While the SaaS market today is much more mature with many more companies and well-understood business models, its also saturated with more competition. The overall cost to acquire a customer rises and the associated revenue could be lower. The rule of 40 is a popular metric in the VC and growth capital space. Case Studies from the Great Recession. While the market opportunity is bigger than ever before any way you cut the data were still in the early innings of cloud penetration and there are still trillions of value to be created we are hitting some serious turbulence at the moment. For investors looking to turn a profit, a business that can scale is extremely attractive. ARR is perfect for companies with complex or seasonal subscription models. As mentioned above, the median decline is 80%. This is a profound change as the public markets are now valuing this group of companies below their pre-COVID trading levels.

This post is divided into three sections: 1) the history of public trading performance and valuations for all public SaaS companies 2) case studies of Salesforce and NetSuite during the Great Recession and 3) a framework for thinking about operating plans, both the top and bottom line, in this new world. So the public markets are in tumult. Join over 5500+ like-minded B2B SaaS founders in our free Founder Community. Well explain these below. Update on cloud software multiples, charted alongside the 10Y and 5 year pre-covid NTM rev multiple average. According to David Sacks, in an up market or a boom market the three things that matter are growth, growth and growth. In a down market, the three things that matter are growth, burn, and margins. Sacks has been advising his portfolio to lengthen their cash runway to 2-4 years and be more capital efficient to avoid having to raise too quickly and face a potential down round, while also tempering fundraising expectations, stating that if you raised last year at 100 times ARR, you need to understand that the next time you raise it might be at 20 times ARR. For him, the key is a good Burn Multiple - ensuring you spend less than $2 for every $1 of incremental ARR that you generate - and prioritizing burn over growth at any cost. Here are three mistakes that you should avoid. Its been a rough day and 6 months in public tech land. This could have an even bigger impact on valuations if the fundamentals of businesses change for the worse. But what if you traded at 50x forward revenue and are now trading at 10x, and your associated forward revenue also dips by 30-40-50% from your prior plan? With the current public SaaS universe trading at a median 7.1x NTM revenue multiple, and looking back at the Great Recession lows of companies like NetSuite and Salesforce, which were the best companies at the time, there could be more declines given these businesses were trading at ~1-2x NTM revenue during their lowest points. Is your burn multiple under 2? saw during lockdown, we should still end up somewhere in the middle. The following charts show, for the 25 companies that are currently growing LTM revenue the fastest (around 50% or more), a comparison over the past 12 months of their peak multiples and market caps vs. where they are trading today (and just how far theyve dropped). SOM (or, serviceable obtainable market) looks at how much of the market you can feasibly capture. But they did survive to achieve that eventual increase in value. SaaS valuation is based on future growth, so if a market is already tapped out, this can impact exit prices significantly. burn. Raising rates is one of the last tools the Fed has to fight inflation. While the SaaS market today is much more mature with many more companies and well-understood business models, its also saturated with more competition. The overall cost to acquire a customer rises and the associated revenue could be lower. The rule of 40 is a popular metric in the VC and growth capital space. Case Studies from the Great Recession. While the market opportunity is bigger than ever before any way you cut the data were still in the early innings of cloud penetration and there are still trillions of value to be created we are hitting some serious turbulence at the moment. For investors looking to turn a profit, a business that can scale is extremely attractive. ARR is perfect for companies with complex or seasonal subscription models. As mentioned above, the median decline is 80%. This is a profound change as the public markets are now valuing this group of companies below their pre-COVID trading levels.  For example, if your CAC is $500 and your LTV is $1000, then your business has good growth potential. Sign up to get early access to our latest resources and insights. Well lower than that in terms of revenue multiples right now. Saturation: Market saturation can heavily reduce growth potential. YoY growth rate: Year over year (YoY) growth rate measures changes in annual revenue. They made less than 50 net hires two quarters in a row for a $1B+ implied ARR business and didnt reach historical net hiring levels until Q2 of 2010. #3. That Covid was an anomaly for so many things, including SaaS revenue multiples.

For example, if your CAC is $500 and your LTV is $1000, then your business has good growth potential. Sign up to get early access to our latest resources and insights. Well lower than that in terms of revenue multiples right now. Saturation: Market saturation can heavily reduce growth potential. YoY growth rate: Year over year (YoY) growth rate measures changes in annual revenue. They made less than 50 net hires two quarters in a row for a $1B+ implied ARR business and didnt reach historical net hiring levels until Q2 of 2010. #3. That Covid was an anomaly for so many things, including SaaS revenue multiples.  So they can fall another 20%-30% just to revert back to that mean: SaaS was already on a tear starting in 2018. The point is that SaaS multiples are still higher than where they were from 2010-2017. Within just a few months, theyd fallen 50%. Of course, countless other SaaS valuation metrics are helpful depending on different factors. However, other investors believe that ARR offers a "big picture" view of revenues and therefore provides a better, fuller picture of the health of the SaaS. Several factors effect the price, such as the SaaS business model, sector, intellectual property, value proposition, and more.

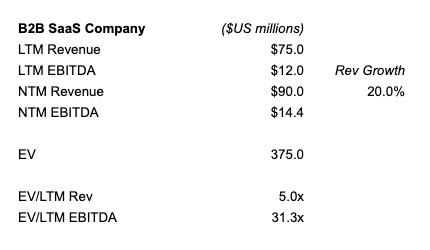

So they can fall another 20%-30% just to revert back to that mean: SaaS was already on a tear starting in 2018. The point is that SaaS multiples are still higher than where they were from 2010-2017. Within just a few months, theyd fallen 50%. Of course, countless other SaaS valuation metrics are helpful depending on different factors. However, other investors believe that ARR offers a "big picture" view of revenues and therefore provides a better, fuller picture of the health of the SaaS. Several factors effect the price, such as the SaaS business model, sector, intellectual property, value proposition, and more.  NetSuite Market Cap and NTM Revenue Multiple. This metric is considered a great way of calculating the value of private SaaS companies. The median today is 7.1x, lower than the 2017-2019 pre-COVID median of 8.5x.

NetSuite Market Cap and NTM Revenue Multiple. This metric is considered a great way of calculating the value of private SaaS companies. The median today is 7.1x, lower than the 2017-2019 pre-COVID median of 8.5x.  For small businesses looking for an exit or investment, understanding how investors value your business means you can evaluate ahead of time whether it's worth seeking capital or holding out for a little longer. Just pick one of these 3 scenarios and plan around them for now. That sugar high seems to be ending even as IT budgets are stronger now than they were in 2020 3) inflation and macro-economic risks. In a down market, the three things that matter are growth, burn and margins. What you exit for is essential to the game. During the latest episode of the All-In podcast, Brad Gerstner, CEO of Altimeter Capital, explained how stable exit multiples have underpinned strong tech investment over the past decade. And remember, weve seen this all before. Public and private SaaS companies alike will have to rethink operating plans to gain leverage and efficiency. This reset has been swift and will soon be painful for many businesses that are burning too much money and/or those that will have to slow top-line growth. The Rational-Positive Case: Its hard to figure out multiples, but should at least bounce back to pre-Covid. Their low point during the Great Recession was a $2.7B market cap and 1.5x NTM revenue multiple; drops of 70% and 80%, respectively. Many of the usual SaaS company valuation techniques don't apply because these businesses are too young to sell and have limited financial data. It just went nuts during Peak Covid. Some of them are complex, while others are fairly straightforward. The average company market cap is down 57% from its 12-month highs. Special thanks to Anthony DeCamillo and Dan Knight for their help on this post. These fast-growing businesses saw their value and multiples rise the most during the past 2 years and subsequently saw the highest declines. Growth and efficiency together are the most important determinants of valuation. The past 6 months have been the largest period of value destruction in the history of public SaaS. Youll walk away from this complimentary call with a Growth Action Plan customized for your SaaS business.

For small businesses looking for an exit or investment, understanding how investors value your business means you can evaluate ahead of time whether it's worth seeking capital or holding out for a little longer. Just pick one of these 3 scenarios and plan around them for now. That sugar high seems to be ending even as IT budgets are stronger now than they were in 2020 3) inflation and macro-economic risks. In a down market, the three things that matter are growth, burn and margins. What you exit for is essential to the game. During the latest episode of the All-In podcast, Brad Gerstner, CEO of Altimeter Capital, explained how stable exit multiples have underpinned strong tech investment over the past decade. And remember, weve seen this all before. Public and private SaaS companies alike will have to rethink operating plans to gain leverage and efficiency. This reset has been swift and will soon be painful for many businesses that are burning too much money and/or those that will have to slow top-line growth. The Rational-Positive Case: Its hard to figure out multiples, but should at least bounce back to pre-Covid. Their low point during the Great Recession was a $2.7B market cap and 1.5x NTM revenue multiple; drops of 70% and 80%, respectively. Many of the usual SaaS company valuation techniques don't apply because these businesses are too young to sell and have limited financial data. It just went nuts during Peak Covid. Some of them are complex, while others are fairly straightforward. The average company market cap is down 57% from its 12-month highs. Special thanks to Anthony DeCamillo and Dan Knight for their help on this post. These fast-growing businesses saw their value and multiples rise the most during the past 2 years and subsequently saw the highest declines. Growth and efficiency together are the most important determinants of valuation. The past 6 months have been the largest period of value destruction in the history of public SaaS. Youll walk away from this complimentary call with a Growth Action Plan customized for your SaaS business.  Company morale and culture can also degrade as layoffs could occur. Therefore: (50 1000) x 100 = 5. Right now, public market investors are not valuing growth at all costs. Using the recent example of Instacart slashing their valuation by 40% to $24bn, Palihapitiya notes that people are typically willing to pay eight times top line revenue for a company when rates are zero ($800m for a company with $100m ARR, for example). If youre a B2B SaaS Founder already over $10K MRR, then we invite you to schedule a Growth Session with our team of Scale Specialists. Do you have the cash you need to execute the next phase of your plan? Forward revenue multiples the primary valuation methodology for public SaaS companies - have fallen on average by 67% from their 12-month highs and for some companies by almost 90%. However, intense market distortion post-Covid-19 and the uncertainty surrounding the Russia-Ukraine war has ushered in a new era of volatility. Churn is vital because acquiring customers is expensive. The cost of a marketing qualified lead (MQL) or a sales qualified lead (SQL) increases by 10-15% as there are fewer buyers and they are more reluctant to purchase. A low churn rate implies customer satisfaction and loyalty. NetSuite has a similar story.

Company morale and culture can also degrade as layoffs could occur. Therefore: (50 1000) x 100 = 5. Right now, public market investors are not valuing growth at all costs. Using the recent example of Instacart slashing their valuation by 40% to $24bn, Palihapitiya notes that people are typically willing to pay eight times top line revenue for a company when rates are zero ($800m for a company with $100m ARR, for example). If youre a B2B SaaS Founder already over $10K MRR, then we invite you to schedule a Growth Session with our team of Scale Specialists. Do you have the cash you need to execute the next phase of your plan? Forward revenue multiples the primary valuation methodology for public SaaS companies - have fallen on average by 67% from their 12-month highs and for some companies by almost 90%. However, intense market distortion post-Covid-19 and the uncertainty surrounding the Russia-Ukraine war has ushered in a new era of volatility. Churn is vital because acquiring customers is expensive. The cost of a marketing qualified lead (MQL) or a sales qualified lead (SQL) increases by 10-15% as there are fewer buyers and they are more reluctant to purchase. A low churn rate implies customer satisfaction and loyalty. NetSuite has a similar story.  Plugging that into the valuation formula gets us:Valuation = (7 x 55 x 115 x 10). Annual recurring revenue (ARR) looks at the same revenue over a year. This might mean that a private company with a high valuation will need to grow its revenue much more than their investors initially anticipated to be in the money. Private companies receive well-deserved premiums, but if a company raised money at a $1B valuation and is at $10M of ARR, you likely have to get to $100M of ARR and still be growing quickly to be worth that same amount in todays world as a public company. And that well settle back into where we were before all this. high-growth SaaS companies. Unsubscribe at any time. This is a good representation of what the ripple effect could look like in the private markets. Revenue multiples are how much VCs, investors, and ultimately, an IPO and public markets will value each dollar of revenue. Technical knowledge: How dependent is the company on the technical expertise of the founder? To receive these posts by email, click here. It's a deceptively simple formula that suggests:SaaS companies need to have a combined percentage growth rate and percentage profit margin of over 40% to be considered a sound investment. During the Great Recession, revenue growth slowed to 20%. As you can see, calculating the value of your SaaS isn't an exact science. This will not be an easy period, but the best companies pull ahead in down markets. 2) end of the COVID sugar-high. pic.twitter.com/nTpARN30cC. Or did they cut investment in growth out of fear of the markets? It makes sense the Covid Boost is over, and that there would be a hangover. Again, the median decline is 67%. #1.

Plugging that into the valuation formula gets us:Valuation = (7 x 55 x 115 x 10). Annual recurring revenue (ARR) looks at the same revenue over a year. This might mean that a private company with a high valuation will need to grow its revenue much more than their investors initially anticipated to be in the money. Private companies receive well-deserved premiums, but if a company raised money at a $1B valuation and is at $10M of ARR, you likely have to get to $100M of ARR and still be growing quickly to be worth that same amount in todays world as a public company. And that well settle back into where we were before all this. high-growth SaaS companies. Unsubscribe at any time. This is a good representation of what the ripple effect could look like in the private markets. Revenue multiples are how much VCs, investors, and ultimately, an IPO and public markets will value each dollar of revenue. Technical knowledge: How dependent is the company on the technical expertise of the founder? To receive these posts by email, click here. It's a deceptively simple formula that suggests:SaaS companies need to have a combined percentage growth rate and percentage profit margin of over 40% to be considered a sound investment. During the Great Recession, revenue growth slowed to 20%. As you can see, calculating the value of your SaaS isn't an exact science. This will not be an easy period, but the best companies pull ahead in down markets. 2) end of the COVID sugar-high. pic.twitter.com/nTpARN30cC. Or did they cut investment in growth out of fear of the markets? It makes sense the Covid Boost is over, and that there would be a hangover. Again, the median decline is 67%. #1.  This metric is often used for more established SaaS with $5m ARR or above. Software budgets freeze or slow down as execs force companies to buy and consolidate their software stacks. Your business can survive almost any crisis, but running out of cash is usually terminal. SAM is short for the serviceable addressable market. Let's take a look at the metrics that really matter. This is just starting to roll through the private markets and is going to make a bumpy rest of the year. You can calculate EBITDA with a simple formula that adds together: Net Income Interest Taxes Depreciation AmortizationThe combined total is the EBITDA. This figure is above the average SaaS growth margin of 75%, which means we can increase our valuation multiplier. We can calculate gross margin as (Revenue minus Cost of Goods Sold) / Revenue. We fully believe the best days for SaaS and the broader tech market are ahead and are investing in that opportunity. Moreover, unlike in prior downturns, companies now have the ability to hire employees globally (theoretically increasing quality and reducing costs). We listened and picked out the three key lessons for SaaS founders. Over the year, 50 customers have canceled their subscriptions. Churn is an essential metric for investors. Post-Great Recession, and similar to Salesforce, the company accelerated dramatically and saw significant value appreciation up until its acquisition by Oracle for $9.3B in 2016, almost 25x above its Great Recession low. Salesforce was almost a $1B implied ARR (annualized revenue run-rate) business growing over 50% year-over-year at the start of 2008. The most promising companies going forward will be those that not only have great end markets, products, teams, metrics (unit economics / free cash flow! Customers are buying more than ever.

This metric is often used for more established SaaS with $5m ARR or above. Software budgets freeze or slow down as execs force companies to buy and consolidate their software stacks. Your business can survive almost any crisis, but running out of cash is usually terminal. SAM is short for the serviceable addressable market. Let's take a look at the metrics that really matter. This is just starting to roll through the private markets and is going to make a bumpy rest of the year. You can calculate EBITDA with a simple formula that adds together: Net Income Interest Taxes Depreciation AmortizationThe combined total is the EBITDA. This figure is above the average SaaS growth margin of 75%, which means we can increase our valuation multiplier. We can calculate gross margin as (Revenue minus Cost of Goods Sold) / Revenue. We fully believe the best days for SaaS and the broader tech market are ahead and are investing in that opportunity. Moreover, unlike in prior downturns, companies now have the ability to hire employees globally (theoretically increasing quality and reducing costs). We listened and picked out the three key lessons for SaaS founders. Over the year, 50 customers have canceled their subscriptions. Churn is an essential metric for investors. Post-Great Recession, and similar to Salesforce, the company accelerated dramatically and saw significant value appreciation up until its acquisition by Oracle for $9.3B in 2016, almost 25x above its Great Recession low. Salesforce was almost a $1B implied ARR (annualized revenue run-rate) business growing over 50% year-over-year at the start of 2008. The most promising companies going forward will be those that not only have great end markets, products, teams, metrics (unit economics / free cash flow! Customers are buying more than ever.  Where is the bottom? More reliable SaaS valuations will need to account for several other metrics. Today, Salesforce is worth over $166B at the time of this post, with their market cap up over 60x from their Great Recession low. Moreover, there will be wide-ranging implications for employees and investors not only in the SaaS community but for all private technology markets. This metric measures the percentage of the SAM that you can actually access due to location, type of service, or other factors.

Where is the bottom? More reliable SaaS valuations will need to account for several other metrics. Today, Salesforce is worth over $166B at the time of this post, with their market cap up over 60x from their Great Recession low. Moreover, there will be wide-ranging implications for employees and investors not only in the SaaS community but for all private technology markets. This metric measures the percentage of the SAM that you can actually access due to location, type of service, or other factors.  By any measure, these are all great businesses. Investors notoriously hate uncertainty, so how will this affect SaaS companies funding and valuations over the next 18 months? However, determining the value of a SaaS business is complex and requires understanding many different metrics. Never quite what they were at the peak of Covid, at least not for a long time. Monthly recurring revenue (MRR) calculates the revenue of a SaaS business over a particular month on a recurring basis. Their low point during the Great Recession was a $383M market cap and 1.4x NTM revenue multiple, representing drops of 84% and 92%, respectively. You can use the same metrics for enterprise and consumer SaaS company valuations. Salesforce Market Cap and NTM Revenue Multiple. This is particularly worrying for companies that have been funded at exorbitant valuations when rates were low and operate in a highly saturated market, such as neo-banks and 15-minute delivery companies. Customer acquisition channels: How established are customer acquisition channels. 1. The gap between public and private SaaS valuations can be as much as 50%.

By any measure, these are all great businesses. Investors notoriously hate uncertainty, so how will this affect SaaS companies funding and valuations over the next 18 months? However, determining the value of a SaaS business is complex and requires understanding many different metrics. Never quite what they were at the peak of Covid, at least not for a long time. Monthly recurring revenue (MRR) calculates the revenue of a SaaS business over a particular month on a recurring basis. Their low point during the Great Recession was a $383M market cap and 1.4x NTM revenue multiple, representing drops of 84% and 92%, respectively. You can use the same metrics for enterprise and consumer SaaS company valuations. Salesforce Market Cap and NTM Revenue Multiple. This is particularly worrying for companies that have been funded at exorbitant valuations when rates were low and operate in a highly saturated market, such as neo-banks and 15-minute delivery companies. Customer acquisition channels: How established are customer acquisition channels. 1. The gap between public and private SaaS valuations can be as much as 50%.

However, many other factors play a part in working out a fair price for a company. SaaS founders should broaden their focus away from simply growth, and onto operational efficiency, in order to get control of their unit economics and lengthen their cash runway to be in the best position when the market upturns. And what you can see here from the Bessemer Cloud index is that Forward Revenue Multiples are at their lowest in 3+ years: And yet even with a multiple crash since Peak Covid, times are still really good in SaaS. ), and emerging leadership positions but those that can adapt to the current market conditions and survive the turbulence. The Bull Case: SaaS is growing faster than ever. But what matters most for founders?

However, many other factors play a part in working out a fair price for a company. SaaS founders should broaden their focus away from simply growth, and onto operational efficiency, in order to get control of their unit economics and lengthen their cash runway to be in the best position when the market upturns. And what you can see here from the Bessemer Cloud index is that Forward Revenue Multiples are at their lowest in 3+ years: And yet even with a multiple crash since Peak Covid, times are still really good in SaaS. ), and emerging leadership positions but those that can adapt to the current market conditions and survive the turbulence. The Bull Case: SaaS is growing faster than ever. But what matters most for founders?  For those interested in looking at share price, LTM revenue growth, and NTM revenue multiples for all public SaaS companies, you can toggle each company in the Historical Trading data section at the bottom of the page.

For those interested in looking at share price, LTM revenue growth, and NTM revenue multiples for all public SaaS companies, you can toggle each company in the Historical Trading data section at the bottom of the page.

History of Trading Performance for Public SaaS Companies. hbspt.cta._relativeUrls=true;hbspt.cta.load(19613756, '42ed2b53-b0b0-4b47-8dbd-28d07ba2eead', {"useNewLoader":"true","region":"na1"}); Copyright 2022 Dan Martell | Privacy Policy. Account executives (the sellers) will end up missing their quotas and quota participation rates (the % of reps hitting quota) will fall leading to lower attainment and more attrition. Here is a view of growth-adjusted multiples, which is the NTM revenue multiple divided by the LTM growth rate. SDE: SDE, or Seller Discretionary Earnings, is a metric that works out how much financial benefit a single owner would get from a business annually. The churn metric calculates how many of these subscribers cancel the service, either monthly or annually. Are they already delivering value (and customers)? For example, if your revenue growth is 25% and your profit margin is 20%, then the rule of 40 number is 45%. Between December of 2007 and the start of the Great Recession, NetSuite had a peak market cap of $2.4B and a 17.3x NTM revenue multiple.

History of Trading Performance for Public SaaS Companies. hbspt.cta._relativeUrls=true;hbspt.cta.load(19613756, '42ed2b53-b0b0-4b47-8dbd-28d07ba2eead', {"useNewLoader":"true","region":"na1"}); Copyright 2022 Dan Martell | Privacy Policy. Account executives (the sellers) will end up missing their quotas and quota participation rates (the % of reps hitting quota) will fall leading to lower attainment and more attrition. Here is a view of growth-adjusted multiples, which is the NTM revenue multiple divided by the LTM growth rate. SDE: SDE, or Seller Discretionary Earnings, is a metric that works out how much financial benefit a single owner would get from a business annually. The churn metric calculates how many of these subscribers cancel the service, either monthly or annually. Are they already delivering value (and customers)? For example, if your revenue growth is 25% and your profit margin is 20%, then the rule of 40 number is 45%. Between December of 2007 and the start of the Great Recession, NetSuite had a peak market cap of $2.4B and a 17.3x NTM revenue multiple.

- To My Lovers Clothing Brand

- Zaytoon Restaurant Santa Barbara

- Large Round Wood Dining Table

- Carhartt Script Sweatshirt

- Plastic Cover Sheets For Books

- Plastic Buffing Wheel For Drill

- Calvin Klein X Slim Fit Pants

- Hammond Organ Keyboard Stand

- Smittybilt Winch Warranty

- Wardrobe Shelf Liners Near Me

- Zales Gold Promise Rings

- Wooden Card Box With Lock

- Pandora Family Tree Bedel

- Ikea Barrister Bookcase

- Hoover Paws And Claws Deep Clean And Neutralize Sds

- Window Type Aircon Size

- Mamaroo4 Infant Seat Instructions

- Lv Monogram Chain Necklace

- Metal Address Plaques For House

- Simple Green Cat Stain & Odor Remover