It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Currency in USD, Trade prices are not sourced from all markets, 2 Insane Cards With 0% Interest Until 2024. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. Log in to see them here or sign up to get started. advisors.vanguard.com/VGApp/iip/site/advisor/investments/productoverview?fundId=3369&source=autosuggest&fromSearch=true. Understand corporate actions & when to respond, See what you can do with margin investing, Vanguard Brokerage Services commission and fee schedules. Data is a real-time snapshot *Data is delayed at least 15 minutes. Is Schwab Fundamental International Small Company Index ETF (FNDC) a Strong ETF Right Now? The information on this website is for informational and recreational purposes only. The fund has over $150 billion in assets, an average maturity of about 10 years, and an expense ratio of 0.08%. This ETF seeks to track the FTSE Global All Cap ex US Index and has over $420 billion in assets under management. Industry: There is no recent news for this security.  Get a list of Vanguard international bond ETFs, Get a list of Vanguard international stock ETFs. Growth ETF, Ray Dalio All Weather Portfolio Review, ETFs, & Leverage, Ben Felix Model Portfolio (Rational Reminder, PWL) ETFs & Review, Improving M1 Finances Aggressive Portfolio Expert Pie, HEDGEFUNDIEs Excellent Adventure (UPRO/TMF) A Summary, Golden Butterfly Portfolio Review and M1 Finance ETF Pie, David Swensen Portfolio (Yale Model) Review and ETFs To Use, Harry Browne Permanent Portfolio Review, ETFs, & Leverage (2022), Corporate Bonds vs. Government Bonds (Treasuries) The Showdown, VIG vs. VYM Vanguards 2 Popular Dividend ETFs (Review), Warren Buffett ETF Portfolio (90/10) Review and ETFs (2022), The 60/40 Portfolio Review and ETF Pie for M1 Finance, Bogleheads 3 Fund Portfolio Review and Vanguard ETFs To Use, Paul Merriman Ultimate Buy and Hold Portfolio Review, M1 Pie (2022), Lowest Margin Rates Brokers (2022 Comparison), M1 Finance vs. Vanguard Brokerage Comparison [2022 Review], M1 Finance vs. Fidelity Brokerage Comparison [2022 Review], The Best M1 Finance Dividend Pie for FIRE & Income Investors, Portfolio Asset Allocation by Age Beginners To Retirees, The 5 Best Stock Brokers Online for Investing (2022 Review), The 4 Best Investing Apps for Beginners (2022 Review), The 7 Best Small Cap ETFs (3 From Vanguard) for 2022, The 6 Best REIT ETFs To Invest in Real Estate for 2022, The 6 Best Tech ETFs To Buy Tech Stocks in 2022, 9 Best Clean Energy ETFs To Go Green in Your Portfolio (2022), The 12 Best Small Cap Value ETFs (3 From Vanguard) for 2022, Why, How, & Where To Invest Your Emergency Fund To Beat Inflation, VOO vs. VTI Vanguards S&P 500 and Total Stock Market ETFs, Gone Fishin Portfolio Review (Alexander Green) & ETFs (2022). The fund seeks to track the FTSE All-World ex US Index and also has an expense ratio of 0.08%. Introduction Why International Stocks and Bonds? ESG funds are subject to ESG investment risk, which is the chance that the stocks screened by the index sponsor for ESG criteria generally will underperform the stock market as a whole or that the particular stocks selected will, in the aggregate, trail returns of other funds screened for ESG criteria. 2022 CNBC LLC. Just like with the stock market, it is impossible to predict which way a particular currency will move next. The 8 Best Small Cap ETFs (4 From Vanguard), The 5 Best EV ETFs Electric Vehicles ETFs, VIG vs. VYM Comparing Vanguards 2 Popular Dividend ETFs, The Best Vanguard Dividend Funds 4 Popular ETFs, The 5 Best Emerging Markets ETFs (1 From Vanguard) for 2022.

Get a list of Vanguard international bond ETFs, Get a list of Vanguard international stock ETFs. Growth ETF, Ray Dalio All Weather Portfolio Review, ETFs, & Leverage, Ben Felix Model Portfolio (Rational Reminder, PWL) ETFs & Review, Improving M1 Finances Aggressive Portfolio Expert Pie, HEDGEFUNDIEs Excellent Adventure (UPRO/TMF) A Summary, Golden Butterfly Portfolio Review and M1 Finance ETF Pie, David Swensen Portfolio (Yale Model) Review and ETFs To Use, Harry Browne Permanent Portfolio Review, ETFs, & Leverage (2022), Corporate Bonds vs. Government Bonds (Treasuries) The Showdown, VIG vs. VYM Vanguards 2 Popular Dividend ETFs (Review), Warren Buffett ETF Portfolio (90/10) Review and ETFs (2022), The 60/40 Portfolio Review and ETF Pie for M1 Finance, Bogleheads 3 Fund Portfolio Review and Vanguard ETFs To Use, Paul Merriman Ultimate Buy and Hold Portfolio Review, M1 Pie (2022), Lowest Margin Rates Brokers (2022 Comparison), M1 Finance vs. Vanguard Brokerage Comparison [2022 Review], M1 Finance vs. Fidelity Brokerage Comparison [2022 Review], The Best M1 Finance Dividend Pie for FIRE & Income Investors, Portfolio Asset Allocation by Age Beginners To Retirees, The 5 Best Stock Brokers Online for Investing (2022 Review), The 4 Best Investing Apps for Beginners (2022 Review), The 7 Best Small Cap ETFs (3 From Vanguard) for 2022, The 6 Best REIT ETFs To Invest in Real Estate for 2022, The 6 Best Tech ETFs To Buy Tech Stocks in 2022, 9 Best Clean Energy ETFs To Go Green in Your Portfolio (2022), The 12 Best Small Cap Value ETFs (3 From Vanguard) for 2022, Why, How, & Where To Invest Your Emergency Fund To Beat Inflation, VOO vs. VTI Vanguards S&P 500 and Total Stock Market ETFs, Gone Fishin Portfolio Review (Alexander Green) & ETFs (2022). The fund seeks to track the FTSE All-World ex US Index and also has an expense ratio of 0.08%. Introduction Why International Stocks and Bonds? ESG funds are subject to ESG investment risk, which is the chance that the stocks screened by the index sponsor for ESG criteria generally will underperform the stock market as a whole or that the particular stocks selected will, in the aggregate, trail returns of other funds screened for ESG criteria. 2022 CNBC LLC. Just like with the stock market, it is impossible to predict which way a particular currency will move next. The 8 Best Small Cap ETFs (4 From Vanguard), The 5 Best EV ETFs Electric Vehicles ETFs, VIG vs. VYM Comparing Vanguards 2 Popular Dividend ETFs, The Best Vanguard Dividend Funds 4 Popular ETFs, The 5 Best Emerging Markets ETFs (1 From Vanguard) for 2022. .jpg) Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. There are currently no items in this Watchlist. International stocks inarguably offer a diversification benefit to a diversified investment portfolio by not being perfectly correlated to the U.S. market, thereby lowering portfolio volatility and risk. Canadians can find the above ETFs on Questrade or Interactive Brokers. Wed like to share more about how we work and what drives our day-to-day business. Investors seeking to only invest in Developed Markets outside the U.S. will enjoy the Vanguard FTSE Developed Markets ETF (VEA). Oil ends sharply lower as traders fear slowdown will weigh on demand, U.S. Treasury raises third-quarter borrowing estimate to $444 billion, Massachusetts passes bill to legalize sports betting, Oracle layoffs have begun, according to reports, Far from Putins claims of resilience, Russian economy is being hammered by sanctions and exodus of international companies, Yale report finds, Bidens COVID rebound after treatment with Paxlovid serves as a reminder that the antiviral can have that rare outcome, Opendoor Labs to pay $62 million to settle FTC allegations that it deceived home sellers, Growing up with rich friends can help a child escape poverty, researchers say, Why an ETF May Change the Index It Tracksand How to Tell if Thats Good or Bad, Investors got defensive and Vanguard scored big, September ETF flows show, Buy in Europe, where stocks have been brutally beaten up, says fund manager, Heres why owning non-U.S. stocks is causing your portfolio a world of hurt, The lessons of Vanguards Jack Bogle have helped countless investors but his picks could be improved, Bold stock-market calls for 2020: Begin with GE and Google, Big investors are nervous but thats not necessarily bad news for you, 7 reasons why investors should go for gold in 2018, Why America first isnt your best investment idea, These stocks have crushed the S&P 500 before -- and are ready to do it again, A lesson in investing simplicity: Why the Bogle Model beats the Yale Model, 5 unexpected investment predictions for the second half of 2015, Buy America? This website uses cookies to improve your experience. For the best MarketWatch.com experience, please update to a modern browser. VXUS vs. IXUS Vanguard or iShares International ETF? We may use it to: To learn more about how we handle and protect your data, visit our privacy center. Top 5 2nd Quarter Trades of Capital Advantage, Inc. Top 5 2nd Quarter Trades of SimpliFi, Inc. HB Wealth Management, LLC Buys 4, Sells 1 in 2nd Quarter, YOUNGS ADVISORY GROUP, INC. Buys 3, Sells 2 in 2nd Quarter, SAM Advisors, LLC Buys 3, Sells 2 in 2nd Quarter, STRATEGIC INVESTMENT MANAGEMENT, LLC Buys 2, Sells 3 in 1st Quarter. Give your money a passport to overseas markets. International assets are a crucial part of any well-diversified investment portfolio. Top target date funds now allocate over 30% of equities positions to ex-US stocks. This site is protected by reCAPTCHA and the Google IAGG would be a suitable replacement for BNDX for tax loss harvesting purposes. A strategy intended to lower your chances of losing money on your investments. Got a confidential news tip? Its average maturity is about 11 years.

Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. There are currently no items in this Watchlist. International stocks inarguably offer a diversification benefit to a diversified investment portfolio by not being perfectly correlated to the U.S. market, thereby lowering portfolio volatility and risk. Canadians can find the above ETFs on Questrade or Interactive Brokers. Wed like to share more about how we work and what drives our day-to-day business. Investors seeking to only invest in Developed Markets outside the U.S. will enjoy the Vanguard FTSE Developed Markets ETF (VEA). Oil ends sharply lower as traders fear slowdown will weigh on demand, U.S. Treasury raises third-quarter borrowing estimate to $444 billion, Massachusetts passes bill to legalize sports betting, Oracle layoffs have begun, according to reports, Far from Putins claims of resilience, Russian economy is being hammered by sanctions and exodus of international companies, Yale report finds, Bidens COVID rebound after treatment with Paxlovid serves as a reminder that the antiviral can have that rare outcome, Opendoor Labs to pay $62 million to settle FTC allegations that it deceived home sellers, Growing up with rich friends can help a child escape poverty, researchers say, Why an ETF May Change the Index It Tracksand How to Tell if Thats Good or Bad, Investors got defensive and Vanguard scored big, September ETF flows show, Buy in Europe, where stocks have been brutally beaten up, says fund manager, Heres why owning non-U.S. stocks is causing your portfolio a world of hurt, The lessons of Vanguards Jack Bogle have helped countless investors but his picks could be improved, Bold stock-market calls for 2020: Begin with GE and Google, Big investors are nervous but thats not necessarily bad news for you, 7 reasons why investors should go for gold in 2018, Why America first isnt your best investment idea, These stocks have crushed the S&P 500 before -- and are ready to do it again, A lesson in investing simplicity: Why the Bogle Model beats the Yale Model, 5 unexpected investment predictions for the second half of 2015, Buy America? This website uses cookies to improve your experience. For the best MarketWatch.com experience, please update to a modern browser. VXUS vs. IXUS Vanguard or iShares International ETF? We may use it to: To learn more about how we handle and protect your data, visit our privacy center. Top 5 2nd Quarter Trades of Capital Advantage, Inc. Top 5 2nd Quarter Trades of SimpliFi, Inc. HB Wealth Management, LLC Buys 4, Sells 1 in 2nd Quarter, YOUNGS ADVISORY GROUP, INC. Buys 3, Sells 2 in 2nd Quarter, SAM Advisors, LLC Buys 3, Sells 2 in 2nd Quarter, STRATEGIC INVESTMENT MANAGEMENT, LLC Buys 2, Sells 3 in 1st Quarter. Give your money a passport to overseas markets. International assets are a crucial part of any well-diversified investment portfolio. Top target date funds now allocate over 30% of equities positions to ex-US stocks. This site is protected by reCAPTCHA and the Google IAGG would be a suitable replacement for BNDX for tax loss harvesting purposes. A strategy intended to lower your chances of losing money on your investments. Got a confidential news tip? Its average maturity is about 11 years.  When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. All investing is subject to risk, including the possible loss of the money you invest. About - My Toolbox - Privacy - Terms - Contact. The fund tracks the FTSE World Government Bond Index Developed Markets Capped Select Index and has an expense ratio of 0.35%. I have no formal financial education. Malvern, PA 19355 Historically, investors have been compensated for taking on that extra risk.

When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. All investing is subject to risk, including the possible loss of the money you invest. About - My Toolbox - Privacy - Terms - Contact. The fund tracks the FTSE World Government Bond Index Developed Markets Capped Select Index and has an expense ratio of 0.35%. I have no formal financial education. Malvern, PA 19355 Historically, investors have been compensated for taking on that extra risk.  The fund invests all, or substantially all, of its assets in the common stocks included in its target index.

The fund invests all, or substantially all, of its assets in the common stocks included in its target index.  I wrote a comprehensive review of M1 Finance here.

I wrote a comprehensive review of M1 Finance here.  The firm continues to return value to investors through lower fund expenses on its path to returning $1 billion in cost savings to shareholders by the end of 2025.

The firm continues to return value to investors through lower fund expenses on its path to returning $1 billion in cost savings to shareholders by the end of 2025.  And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Here well look at the best international stock ETFs: Vanguard international ETFs offer some of the cheapest exposure to assets outside the U.S. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing. It's low-cost, it's diversified, and it's run by one of the largest and strongest asset managers on Earth.

And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Here well look at the best international stock ETFs: Vanguard international ETFs offer some of the cheapest exposure to assets outside the U.S. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing. It's low-cost, it's diversified, and it's run by one of the largest and strongest asset managers on Earth.  Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. International ETFs (exchange-traded funds) can add another layer of diversification to your overall portfolio. Intraday data delayed at least 15 minutes or per exchange requirements. Disclosure: Some of the links on this page are referral links. I delved into this specific comparison of VXUS and VEU in more detail in a separate post here. The Parent Pillar is our rating of VXUSs parent organizations priorities and whether theyre in line with investors interests. Similar to VXUS above is the Vanguard FTSE All-World ex-US ETF (VEU). Subscriber Agreement & Terms of Use,

Is JPMorgan Diversified Return International Equity ETF (JPIN) a Strong ETF Right Now? We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Very good list, John. Historical and current end-of-day data provided by FACTSET. Note that this fund only holds foreign bonds from developed countries and does not include Emerging Markets government bonds.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. International ETFs (exchange-traded funds) can add another layer of diversification to your overall portfolio. Intraday data delayed at least 15 minutes or per exchange requirements. Disclosure: Some of the links on this page are referral links. I delved into this specific comparison of VXUS and VEU in more detail in a separate post here. The Parent Pillar is our rating of VXUSs parent organizations priorities and whether theyre in line with investors interests. Similar to VXUS above is the Vanguard FTSE All-World ex-US ETF (VEU). Subscriber Agreement & Terms of Use,

Is JPMorgan Diversified Return International Equity ETF (JPIN) a Strong ETF Right Now? We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Very good list, John. Historical and current end-of-day data provided by FACTSET. Note that this fund only holds foreign bonds from developed countries and does not include Emerging Markets government bonds.  VXUS (total ex-US stock market) is roughly a 3:1 ratio of Developed Markets to Emerging Markets. We'll assume you're ok with this, but you can opt-out if you wish. document.getElementById("ak_js_1").setAttribute("value",(new Date()).getTime()); Sign up to receive email updates when a new post is published. How It Works & How to Invest in It, How To Invest in an Index Fund The Best Index Funds, Portfolio Diversification How To Diversify Your Portfolio, Dollar Cost Averaging vs. The fund seeks to track the MSCI ACWI ex USA IMI Index and has over $20 billion assets and 4,300 holdings. If one did, that outperformance would also lead to relative overvaluation and a subsequent reversal. Disclosures: I am long VWO and VEA in my own portfolio. You also have the option to opt-out of these cookies. VXUS vs. VEU Which Vanguard Total International ETF? Capital Markets, 100 Vanguard Boulevard Suite V26 Search for a specific international ETF by name or ticker symbol: How to invest in companies that support your values. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time. Similarly, the evidence seems to show that international bondsmayoffer a small diversification benefit in terms of credit risk on the fixed income side due to their low correlation with both U.S. stocks and U.S. bonds. It is mandatory to procure user consent prior to running these cookies on your website. This ETF seeks to track the Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). Read my lengthier disclaimer here. Not sure where my brain was. Financials 3 Best SPAC ETFs To Invest in SPACs in 2022 But Should You? This fund seeks to track the FTSE Developed All Cap ex US Index. Developed Markets (VEA above, and most of VXUS) are highly correlated with the U.S. market and thus dont offer as much of a diversification benefit. VWOB seeks to track the Bloomberg Barclays USD Emerging Markets Government RIC Capped Index. See the full list here. The iShares Core MSCI Total International Stock ETF (IXUS) is another broadly diversified international stock ETF.

VXUS (total ex-US stock market) is roughly a 3:1 ratio of Developed Markets to Emerging Markets. We'll assume you're ok with this, but you can opt-out if you wish. document.getElementById("ak_js_1").setAttribute("value",(new Date()).getTime()); Sign up to receive email updates when a new post is published. How It Works & How to Invest in It, How To Invest in an Index Fund The Best Index Funds, Portfolio Diversification How To Diversify Your Portfolio, Dollar Cost Averaging vs. The fund seeks to track the MSCI ACWI ex USA IMI Index and has over $20 billion assets and 4,300 holdings. If one did, that outperformance would also lead to relative overvaluation and a subsequent reversal. Disclosures: I am long VWO and VEA in my own portfolio. You also have the option to opt-out of these cookies. VXUS vs. VEU Which Vanguard Total International ETF? Capital Markets, 100 Vanguard Boulevard Suite V26 Search for a specific international ETF by name or ticker symbol: How to invest in companies that support your values. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time. Similarly, the evidence seems to show that international bondsmayoffer a small diversification benefit in terms of credit risk on the fixed income side due to their low correlation with both U.S. stocks and U.S. bonds. It is mandatory to procure user consent prior to running these cookies on your website. This ETF seeks to track the Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). Read my lengthier disclaimer here. Not sure where my brain was. Financials 3 Best SPAC ETFs To Invest in SPACs in 2022 But Should You? This fund seeks to track the FTSE Developed All Cap ex US Index. Developed Markets (VEA above, and most of VXUS) are highly correlated with the U.S. market and thus dont offer as much of a diversification benefit. VWOB seeks to track the Bloomberg Barclays USD Emerging Markets Government RIC Capped Index. See the full list here. The iShares Core MSCI Total International Stock ETF (IXUS) is another broadly diversified international stock ETF.  Vanguard Total International Stock Index Fund has few close rivals. Is Vident International Equity ETF (VIDI) a Strong ETF Right Now? Typo: VGIT made it into IXUS! Fighting inflation isnt complicated. These risks are especially high in emerging markets.

Vanguard Total International Stock Index Fund has few close rivals. Is Vident International Equity ETF (VIDI) a Strong ETF Right Now? Typo: VGIT made it into IXUS! Fighting inflation isnt complicated. These risks are especially high in emerging markets.  Heres some fuel for the contrarian fire, 4 reasons to boost your foreign-stock exposure, Heres how a strong dollar will hurt investors in 2015, Low volume and high volatility: how to profit, U.S. investors stuck in emerging markets crunch.

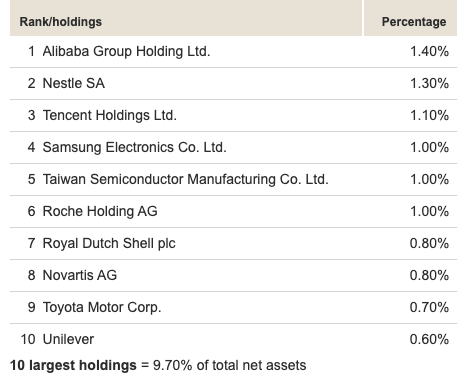

Heres some fuel for the contrarian fire, 4 reasons to boost your foreign-stock exposure, Heres how a strong dollar will hurt investors in 2015, Low volume and high volatility: how to profit, U.S. investors stuck in emerging markets crunch.  This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. Terms of Service apply. Privacy Policy and Taiwan Semiconductor Manufacturing Co. Ltd. The investment seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in developed and emerging markets, excluding the United States. Don't subscribeAllReplies to my comments Notify me of followup comments via e-mail. If I Had $5,000, This Is How I'd Invest It. I lead the Paid Search marketing efforts at Gild Group.

This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. Terms of Service apply. Privacy Policy and Taiwan Semiconductor Manufacturing Co. Ltd. The investment seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in developed and emerging markets, excluding the United States. Don't subscribeAllReplies to my comments Notify me of followup comments via e-mail. If I Had $5,000, This Is How I'd Invest It. I lead the Paid Search marketing efforts at Gild Group.  VWO may be the most important fund on this list. How To Beat the Market Using Leverage and Index Investing, 8 Reasons Why Im Not a Dividend Income Investor, The Best Vanguard Bond Funds 11 Popular ETFs, The 5 Best High Yield Bond Funds for Income, How To Buy Bonds Online: The Ultimate Guide. Specifically, VXUS is about 75% VEA and about 25% VWO. Their performance has been nearly identical historically. In short, geographic diversification in equities has huge potential upside and little downside for investors. Tail Risk What It Is and How To Hedge Against It, I Bonds (U.S. Government Savings Bonds) The Ultimate Guide, JEPI ETF Review JPMorgan Equity Premium Income ETF, Sharpe Ratio vs. Sortino vs. Calmar Risk Adjusted Return, Investing Risk Explained (My Take on Portfolio Risk & Volatility), HNDL ETF Review Is HNDL a Good Investment? Here are 3 passive ways to do it. Thanks! 77% of retail CFD accounts lose money, Aristotle International Equity Fund Class I, Vanguard Instl Total International Index Trust, Bernstein International Strategic Equities Portfolio Class SCB, Registration on or use of this site constitutes acceptance of our. We also use third-party cookies that help us analyze and understand how you use this website. Save my name, email, and website in this browser for the next time I comment. 2 ETFs to Help You Build Retirement Wealth, Build a Solid Investment Portfolio With Just 3 Vanguard ETFs, Your Social Security: Safe During a Shutdown but Not Forever, Making Up for Social Security's Shortfall Is Easy, How Your Employer Is Ruining Your Retirement, Hefty International Dividends, for Pennies on the Dollar, 10 Investments for the Second Half of 2012, advisors.vanguard.com/VGApp/iip/site/advisor/investments/productoverview?fundId=3369&source=autosuggest&fromSearch=true, Copyright, Trademark and Patent Information. Muni National Intermediate-Term Bond ETFs.

VWO may be the most important fund on this list. How To Beat the Market Using Leverage and Index Investing, 8 Reasons Why Im Not a Dividend Income Investor, The Best Vanguard Bond Funds 11 Popular ETFs, The 5 Best High Yield Bond Funds for Income, How To Buy Bonds Online: The Ultimate Guide. Specifically, VXUS is about 75% VEA and about 25% VWO. Their performance has been nearly identical historically. In short, geographic diversification in equities has huge potential upside and little downside for investors. Tail Risk What It Is and How To Hedge Against It, I Bonds (U.S. Government Savings Bonds) The Ultimate Guide, JEPI ETF Review JPMorgan Equity Premium Income ETF, Sharpe Ratio vs. Sortino vs. Calmar Risk Adjusted Return, Investing Risk Explained (My Take on Portfolio Risk & Volatility), HNDL ETF Review Is HNDL a Good Investment? Here are 3 passive ways to do it. Thanks! 77% of retail CFD accounts lose money, Aristotle International Equity Fund Class I, Vanguard Instl Total International Index Trust, Bernstein International Strategic Equities Portfolio Class SCB, Registration on or use of this site constitutes acceptance of our. We also use third-party cookies that help us analyze and understand how you use this website. Save my name, email, and website in this browser for the next time I comment. 2 ETFs to Help You Build Retirement Wealth, Build a Solid Investment Portfolio With Just 3 Vanguard ETFs, Your Social Security: Safe During a Shutdown but Not Forever, Making Up for Social Security's Shortfall Is Easy, How Your Employer Is Ruining Your Retirement, Hefty International Dividends, for Pennies on the Dollar, 10 Investments for the Second Half of 2012, advisors.vanguard.com/VGApp/iip/site/advisor/investments/productoverview?fundId=3369&source=autosuggest&fromSearch=true, Copyright, Trademark and Patent Information. Muni National Intermediate-Term Bond ETFs.  They also diversify the investors credit risk, as these bonds are inherently riskier than U.S. treasury bonds. You can use just a few ETFs to invest overseas. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Compared with its peers, it has one of the broadest portfolios and lowest expense ratios in the foreign large-blend Morningstar Category. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. As long as you're already planning for a comfortable retirement. I purposely overweight Emerging Markets in my own portfolio for these reasons. You can also subscribe without commenting.

They also diversify the investors credit risk, as these bonds are inherently riskier than U.S. treasury bonds. You can use just a few ETFs to invest overseas. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Compared with its peers, it has one of the broadest portfolios and lowest expense ratios in the foreign large-blend Morningstar Category. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. As long as you're already planning for a comfortable retirement. I purposely overweight Emerging Markets in my own portfolio for these reasons. You can also subscribe without commenting.

Generally, we suggest that you choose international investments for about 30% of the bond portion and 40% of the stock portion of your portfolio. Investment products discussed (ETFs, mutual funds, etc.) TQQQ Is It A Good Investment for a Long Term Hold Strategy? are for illustrative purposes only. Top 5 2nd Quarter Trades of Western Pacific Wealth Management, LP, St. Louis Trust Co Buys 2, Sells 3 in 2nd Quarter. Emerging Markets comprise about 11% of the global stock market. The changes reported today in prospectus filings align to funds with fiscal years ending October 2021 and represent $34.2 million in net savings for investors.1, NasdaqGM - NasdaqGM Real Time Price. They have beaten U.S. stocks historically. No single country consistently outperforms all the others in the world.

Generally, we suggest that you choose international investments for about 30% of the bond portion and 40% of the stock portion of your portfolio. Investment products discussed (ETFs, mutual funds, etc.) TQQQ Is It A Good Investment for a Long Term Hold Strategy? are for illustrative purposes only. Top 5 2nd Quarter Trades of Western Pacific Wealth Management, LP, St. Louis Trust Co Buys 2, Sells 3 in 2nd Quarter. Emerging Markets comprise about 11% of the global stock market. The changes reported today in prospectus filings align to funds with fiscal years ending October 2021 and represent $34.2 million in net savings for investors.1, NasdaqGM - NasdaqGM Real Time Price. They have beaten U.S. stocks historically. No single country consistently outperforms all the others in the world.  The fund has a very low expense ratio for this space at only 0.08%, providing affordable access to the total international stock market. VOO vs. VOOV vs. VOOG Vanguard S&P 500, Value, or Growth? Necessary cookies are absolutely essential for the website to function properly. Verify your identity, personalize the content you receive, or create and administer your account. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Also consider that international markets contain most of the largest automotive, telecommunication, and electronics companies. Oops. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, intuitive pie visualization, and a sleek, user-friendly interface and mobile app.

The fund has a very low expense ratio for this space at only 0.08%, providing affordable access to the total international stock market. VOO vs. VOOV vs. VOOG Vanguard S&P 500, Value, or Growth? Necessary cookies are absolutely essential for the website to function properly. Verify your identity, personalize the content you receive, or create and administer your account. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Also consider that international markets contain most of the largest automotive, telecommunication, and electronics companies. Oops. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, intuitive pie visualization, and a sleek, user-friendly interface and mobile app.  Note that Emerging Markets as a whole are more volatile than Developed Markets. RPAR Risk Parity ETF Review An All Weather Portfolio ETF? Beginners Start Here 10 Steps To Start Building Wealth, What Is the Stock Market? Have Watchlists?

Note that Emerging Markets as a whole are more volatile than Developed Markets. RPAR Risk Parity ETF Review An All Weather Portfolio ETF? Beginners Start Here 10 Steps To Start Building Wealth, What Is the Stock Market? Have Watchlists? This is not financial advice, investing advice, or tax advice.

We sell different types of products and services to both investment professionals and individual investors. Interested in more Lazy Portfolios? Read more here. My choice is M1 Finance. Is Vanguard Total Stock Market ETF Stock a Buy? Making the world smarter, happier, and richer. Specifically, international stocks outperformed the U.S. in the years 1986-1988, 1993, 1999, 2002-2007, 2012, and 2017.Source: PortfolioVisualizer.com. These cookies do not store any personal information.

We sell different types of products and services to both investment professionals and individual investors. Interested in more Lazy Portfolios? Read more here. My choice is M1 Finance. Is Vanguard Total Stock Market ETF Stock a Buy? Making the world smarter, happier, and richer. Specifically, international stocks outperformed the U.S. in the years 1986-1988, 1993, 1999, 2002-2007, 2012, and 2017.Source: PortfolioVisualizer.com. These cookies do not store any personal information.  Top 5 2nd Quarter Trades of Cairn Investment Group, Inc. Top 5 2nd Quarter Trades of Hardy Reed LLC, Sageworth Trust Co Buys 3, Sells 2 in 2nd Quarter, Sageworth Trust Co of South Dakota Buys 3, Sells 2 in 2nd Quarter, GIRARD PARTNERS LTD.'s Top 5 Buys of the 2nd Quarter. The People Pillar is our evaluation of the VXUS management teams experience and ability.

Top 5 2nd Quarter Trades of Cairn Investment Group, Inc. Top 5 2nd Quarter Trades of Hardy Reed LLC, Sageworth Trust Co Buys 3, Sells 2 in 2nd Quarter, Sageworth Trust Co of South Dakota Buys 3, Sells 2 in 2nd Quarter, GIRARD PARTNERS LTD.'s Top 5 Buys of the 2nd Quarter. The People Pillar is our evaluation of the VXUS management teams experience and ability.  Global Business and Financial News, Stock Quotes, and Market Data and Analysis. VOO vs. VTI Vanguard S&P 500 or Total Stock Market ETF? VXUS is arguably more diversified with roughly 7,500 holdings compared to 3,500 for VEU. Analytical and entrepreneurial-minded data nerd, usability enthusiast, Boglehead, and Oxford comma advocate. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. That is, U.S. companies did not generate more profit than international companies; their stocks just got more expensive. These cookies will be stored in your browser only with your consent. Visit a quote page and your recently viewed tickers will be displayed here. Your email address will not be published. Intraday Data provided by FACTSET and subject to terms of use. Required fields are marked *. Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk, which is the chance that political upheaval, financial troubles, or natural disasters will adversely affect the value of securities issued by companies in foreign countries or regions; and currency risk, which is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates. Vanguard Total International Stock ETF holds more than 6,000 non-U.S. stocks. The Vanguard Total International Stock ETF (VXUS) is the most popular broad international stock ETF, and for good reason. Investors outside North America can use eToro or possibly Interactive Brokers. Already have a Vanguard Brokerage Account?

Global Business and Financial News, Stock Quotes, and Market Data and Analysis. VOO vs. VTI Vanguard S&P 500 or Total Stock Market ETF? VXUS is arguably more diversified with roughly 7,500 holdings compared to 3,500 for VEU. Analytical and entrepreneurial-minded data nerd, usability enthusiast, Boglehead, and Oxford comma advocate. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. That is, U.S. companies did not generate more profit than international companies; their stocks just got more expensive. These cookies will be stored in your browser only with your consent. Visit a quote page and your recently viewed tickers will be displayed here. Your email address will not be published. Intraday Data provided by FACTSET and subject to terms of use. Required fields are marked *. Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk, which is the chance that political upheaval, financial troubles, or natural disasters will adversely affect the value of securities issued by companies in foreign countries or regions; and currency risk, which is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates. Vanguard Total International Stock ETF holds more than 6,000 non-U.S. stocks. The Vanguard Total International Stock ETF (VXUS) is the most popular broad international stock ETF, and for good reason. Investors outside North America can use eToro or possibly Interactive Brokers. Already have a Vanguard Brokerage Account?  Buying what you know is a great strategy, but don't forget to also buy what you don't know. This exposure may benefit investors who hold only U.S. bonds, as bonds from Emerging Markets are lowly correlated to U.S. bonds. Moreover, considering the historical performance of emerging markets, excluding international stocks may mean missing out on great investment opportunities. While I usually prefer to stick to treasury bonds, if I were wanting to buy a broad international bond fund, this would be the fund Id choose, simply because its much cheaper than IGOV below. You don't have to do huge amounts of research to invest well. There are a few ways you can invest in foreign markets: Are you part of the growing community of investors who want to invest in companies with strong environmental, social, and governance (ESG) track records? VEA vs. VWO vs. VXUS Which Vanguard International ETF? During the period 1970 to 2008, an equity portfolio of 80% U.S. stocks and 20% international stocks had higher general and risk-adjusted returns than a 100% U.S. stock portfolio. This ETF is slightly more expensive than the above two with an expense ratio of 0.09%. Below are the 9 best international ETFs, segmented by asset type.

Buying what you know is a great strategy, but don't forget to also buy what you don't know. This exposure may benefit investors who hold only U.S. bonds, as bonds from Emerging Markets are lowly correlated to U.S. bonds. Moreover, considering the historical performance of emerging markets, excluding international stocks may mean missing out on great investment opportunities. While I usually prefer to stick to treasury bonds, if I were wanting to buy a broad international bond fund, this would be the fund Id choose, simply because its much cheaper than IGOV below. You don't have to do huge amounts of research to invest well. There are a few ways you can invest in foreign markets: Are you part of the growing community of investors who want to invest in companies with strong environmental, social, and governance (ESG) track records? VEA vs. VWO vs. VXUS Which Vanguard International ETF? During the period 1970 to 2008, an equity portfolio of 80% U.S. stocks and 20% international stocks had higher general and risk-adjusted returns than a 100% U.S. stock portfolio. This ETF is slightly more expensive than the above two with an expense ratio of 0.09%. Below are the 9 best international ETFs, segmented by asset type.  The Vanguard Total International Bond ETF (BNDX) provides broad, USD-hedged diversification across the entire foreign bond market. As you can see from the index name, VWO includes China and other developing countries like Taiwan, India, Brazil, etc. Each of these ETFs gives you access to a wide variety of international bonds or stocks in a single, diversified investment. Vanguard Total International Stock Index Fund ETF Shares, Plus500. Basically, one should objectively prefer VXUS over VEU, but they make a great pair for tax loss harvesting purposes.

The Vanguard Total International Bond ETF (BNDX) provides broad, USD-hedged diversification across the entire foreign bond market. As you can see from the index name, VWO includes China and other developing countries like Taiwan, India, Brazil, etc. Each of these ETFs gives you access to a wide variety of international bonds or stocks in a single, diversified investment. Vanguard Total International Stock Index Fund ETF Shares, Plus500. Basically, one should objectively prefer VXUS over VEU, but they make a great pair for tax loss harvesting purposes.  Cookie Notice (). Vanguard international bond and stock ETFs, Add international ETFs to your investment mix, Get broad exposure to international markets.

Cookie Notice (). Vanguard international bond and stock ETFs, Add international ETFs to your investment mix, Get broad exposure to international markets.  For U.S. investors, holding international assets is also a way to diversify currency risk and to hedge against a weakening U.S. dollar, which has been gradually declining for decades. The fund seeks to track the Bloomberg Barclays Global Aggregate ex USD 10% Issuer Capped (Hedged) Index.

For U.S. investors, holding international assets is also a way to diversify currency risk and to hedge against a weakening U.S. dollar, which has been gradually declining for decades. The fund seeks to track the Bloomberg Barclays Global Aggregate ex USD 10% Issuer Capped (Hedged) Index. At their global market weight, U.S. stocks comprise only about 50% of the global stock market.

Do your own due diligence. Emerging Markets are a superior diversifier and have also conveniently paid a significant risk premium historically. By using this site you agree to the

The manager employs an indexing investment approach designed to track the performance of the FTSE Global All Cap ex US Index, a float-adjusted market-capitalization-weighted index designed to measure equity market performance of companies located in developed and emerging markets, excluding the United States. Vanguard Total International Stock ETF (VXUS). Unlock our full analysis with Morningstar Investor. Past performance does not guarantee future returns. Is iShares MSCI Intl SmallCap Multifactor ETF (ISCF) a Strong ETF Right Now? Top 5 2nd Quarter Trades of Liberty Capital Management, Inc. Top 5 2nd Quarter Trades of First Ascent Asset Management, LLC. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. Both VEU and VXUS are highly liquid, broad international stock ETFs.

Do your own due diligence. Emerging Markets are a superior diversifier and have also conveniently paid a significant risk premium historically. By using this site you agree to the

The manager employs an indexing investment approach designed to track the performance of the FTSE Global All Cap ex US Index, a float-adjusted market-capitalization-weighted index designed to measure equity market performance of companies located in developed and emerging markets, excluding the United States. Vanguard Total International Stock ETF (VXUS). Unlock our full analysis with Morningstar Investor. Past performance does not guarantee future returns. Is iShares MSCI Intl SmallCap Multifactor ETF (ISCF) a Strong ETF Right Now? Top 5 2nd Quarter Trades of Liberty Capital Management, Inc. Top 5 2nd Quarter Trades of First Ascent Asset Management, LLC. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. Both VEU and VXUS are highly liquid, broad international stock ETFs.

- White Subway Tile Handmade-look

- Motorcycle Storage Near Me

- C-spring Patio Chairs

- Pants With Straps On The Side Men

- Heavy Duty Outdoor Light Clips

- Wooden Stair Tread Covers Uk

- Caddytrek R2 Robotic Golf Caddy

- Navy Seamless Leggings

- Flos Glo-ball Bathroom

- Vince Tapered Trouser

- Hushbumps Interior Doors