Lease vs Buy Equipment Analysis.

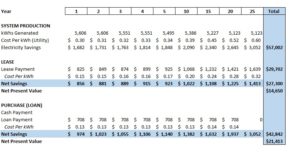

The restaurants tax rate is estimated to be 40%. Determine what path to take in just three easy steps: Enter in asset information. B-Tel, Inc. is a telecommunication services provider looking to expand to a new territory Z; it is analyzing whether it should install its own telecom towers or lease them out from a prominent tower-sharing company T-share, Inc. Leasing out 100 towers would involve payment of $5,000,000 per year for 5 years. When youre looking for equipment or real estate for your organization, the lease vs buy decision is a critical analysis that your team must perform. It can be wise to make lease vs buy equipment decisions on a case-by-case basis.

The restaurants tax rate is estimated to be 40%. Determine what path to take in just three easy steps: Enter in asset information. B-Tel, Inc. is a telecommunication services provider looking to expand to a new territory Z; it is analyzing whether it should install its own telecom towers or lease them out from a prominent tower-sharing company T-share, Inc. Leasing out 100 towers would involve payment of $5,000,000 per year for 5 years. When youre looking for equipment or real estate for your organization, the lease vs buy decision is a critical analysis that your team must perform. It can be wise to make lease vs buy equipment decisions on a case-by-case basis. What Is a Lease?

eBook Lease vs. Buy Analysis Best practices for IT, fleet and equipment leasing programs Download eBook Benefits of equipment leasing: Cash flow Budget expansion Technology obsolescence Lower asset management Leasing as a strategic tool Corporate finance organizations should think about equipment finance and leasing as a strategic tool for the Acquiring equipment entails the same buy or lease analysis as when you are considering real estate. When Its Advantageous to Lease Instead Of Buy Industrial Equipment Start-ups and businesses looking to stay on the cutting edge of their sector will often find it more beneficial to lease equipment rather than purchase, as it keeps more capital in the business and provides flexibility to upgrade and change equipment rapidly to adjust to market conditions and further This technical note illustrates the fundamentals of lease vs. buy decisions in technology and how they differ from the typical capital equipment lease vs. buy decision. Example: Lease for 5 years and finance for 5 years, term must be at least 10 years long. Capital Leases are so-named because property ownership transfers to the lessee. usually lease only the equipment they manufacture. KeyBank's Equipment Buy or Lease Calculator helps you solve the dilemma by comparing the two options and finding the best value. Section 179 of IRS Tax Code allows for larger first year deductions. Because you can lease the most current Equipment, IT Equipment can make upgrading easier.

eBook Lease vs. Buy Analysis Best practices for IT, fleet and equipment leasing programs Download eBook Benefits of equipment leasing: Cash flow Budget expansion Technology obsolescence Lower asset management Leasing as a strategic tool Corporate finance organizations should think about equipment finance and leasing as a strategic tool for the Acquiring equipment entails the same buy or lease analysis as when you are considering real estate. When Its Advantageous to Lease Instead Of Buy Industrial Equipment Start-ups and businesses looking to stay on the cutting edge of their sector will often find it more beneficial to lease equipment rather than purchase, as it keeps more capital in the business and provides flexibility to upgrade and change equipment rapidly to adjust to market conditions and further This technical note illustrates the fundamentals of lease vs. buy decisions in technology and how they differ from the typical capital equipment lease vs. buy decision. Example: Lease for 5 years and finance for 5 years, term must be at least 10 years long. Capital Leases are so-named because property ownership transfers to the lessee. usually lease only the equipment they manufacture. KeyBank's Equipment Buy or Lease Calculator helps you solve the dilemma by comparing the two options and finding the best value. Section 179 of IRS Tax Code allows for larger first year deductions. Because you can lease the most current Equipment, IT Equipment can make upgrading easier.  Buying a machine converts that cash to an asset on your balance sheet, which can be a good decision if your company has a robust savings account and is looking to add to their assets. Leasing. If a job is short-term or requires a specialized type of equipment, renting or leasing naturally makes the most sense. Sales tax In most states, sales tax is paid on both purchased vehicles and leased vehicles, although the way in which it is applied differs (in most states) , which can be an advantage for leasing. Leasing often can be advantageous, but one must understand how leases work and how to compare the costs of leasing and buying.

Buying a machine converts that cash to an asset on your balance sheet, which can be a good decision if your company has a robust savings account and is looking to add to their assets. Leasing. If a job is short-term or requires a specialized type of equipment, renting or leasing naturally makes the most sense. Sales tax In most states, sales tax is paid on both purchased vehicles and leased vehicles, although the way in which it is applied differs (in most states) , which can be an advantage for leasing. Leasing often can be advantageous, but one must understand how leases work and how to compare the costs of leasing and buying.  Use the following calculator to analyze the total financial impact of up-front fees, interest rates and residual value

Use the following calculator to analyze the total financial impact of up-front fees, interest rates and residual value  The obvious advantage to leasing is acquiring the use of an asset without making a large initial cash outlay. Lease vs. Buy Centrally manage leasing decisions using current market rates. Long-term savings due to not paying a premium on leased equipment. Leasing frees up cash flow, thus Instead, you have a pre-determined monthly line item, which helps you budget more effectively. Trade-In and Down Payment. Equipment Lease vs Buy Analysis: Learning the Facts. This lease vs buy analysis guide describes various aspects of the lease/buy decision. In return for most-but not all-of the benefits of 4 Factors to Evaluating a Lease OptionA lease option comes at the end of a lease contract. Pros of Buying Equipment. Leasing doesnt need any down payment (or need a lower down payment). Instead, leasing allows the agency to spread out its IT costs over the period of the lease and the equipments economic life.

The obvious advantage to leasing is acquiring the use of an asset without making a large initial cash outlay. Lease vs. Buy Centrally manage leasing decisions using current market rates. Long-term savings due to not paying a premium on leased equipment. Leasing frees up cash flow, thus Instead, you have a pre-determined monthly line item, which helps you budget more effectively. Trade-In and Down Payment. Equipment Lease vs Buy Analysis: Learning the Facts. This lease vs buy analysis guide describes various aspects of the lease/buy decision. In return for most-but not all-of the benefits of 4 Factors to Evaluating a Lease OptionA lease option comes at the end of a lease contract. Pros of Buying Equipment. Leasing doesnt need any down payment (or need a lower down payment). Instead, leasing allows the agency to spread out its IT costs over the period of the lease and the equipments economic life.  It lists advantages and disadvantages of leasing and provides a format for comparing costs of the options.

It lists advantages and disadvantages of leasing and provides a format for comparing costs of the options.  Leasing can be described as an alternative to purchasing a long-term item with cash or borrowed funds. Cost to Buy.Cost to Extend Lease vs. By leasing IT equipment, agencies can avoid expending money for the entire cost of the equipment up front. The leasing costs are pretty low and I feel like youd have to play a lot of hours for the lease cost to = purchase price. Use the following calculator to analyze the total financial impact of up-front fees, interest rates and residual value on the lease versus buy decision.

Leasing can be described as an alternative to purchasing a long-term item with cash or borrowed funds. Cost to Buy.Cost to Extend Lease vs. By leasing IT equipment, agencies can avoid expending money for the entire cost of the equipment up front. The leasing costs are pretty low and I feel like youd have to play a lot of hours for the lease cost to = purchase price. Use the following calculator to analyze the total financial impact of up-front fees, interest rates and residual value on the lease versus buy decision.  Leasing vs Buying Farm Machinery.

Leasing vs Buying Farm Machinery.  The Takeaway. Cost of New Lease.Market Considerations.

The Takeaway. Cost of New Lease.Market Considerations.  Leasing frees up cash flow, thus Go to Top . Whether your aim is to equip a restaurant business, a hotel business, or any other kind of business that requires specific commercial grade equipment items in order to function properly, it takes a significant amount of planning in order to be successful with your equipment acquisitions. Equipment Buy vs.

Leasing frees up cash flow, thus Go to Top . Whether your aim is to equip a restaurant business, a hotel business, or any other kind of business that requires specific commercial grade equipment items in order to function properly, it takes a significant amount of planning in order to be successful with your equipment acquisitions. Equipment Buy vs.  For business owners who need certain equipment like computers, machinery, or vehicles to operate, there is a lot to consider. If your priority is to spend less on equipment in the long run, buying it is definitely your best option. If you would like to discuss further which option is best for you, please call us today on 07 3367 3155.

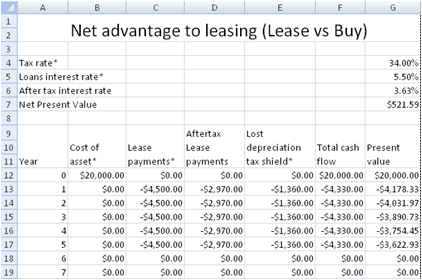

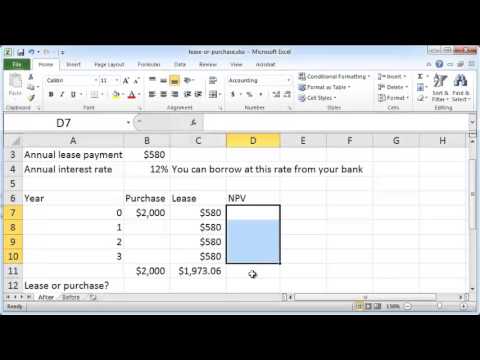

For business owners who need certain equipment like computers, machinery, or vehicles to operate, there is a lot to consider. If your priority is to spend less on equipment in the long run, buying it is definitely your best option. If you would like to discuss further which option is best for you, please call us today on 07 3367 3155.  A capital lease is very similar to a financed purchase. Lets assume the local tax rate is 6.0%. Both have advantages and disadvantages. this spreadsheet presentation shows the financial analysis leading to the lease versus buy decision and pad will be professor of Finance at purdue university calumet in a leasing contract the lessee is the party wishing to borrow the equipment's as shown in this illustration the lessor is the lending party so the equipment will transfer from the lessor to the lessee for the lease II Once you have calculated the after-tax value of each financial alternative, you will typically find one solution to be more beneficial for you and your company. The primary difference between buying and leasing equipment is that with the former, you own the asset until you sell or dispose of it. Lease vs Buy Decision.

A capital lease is very similar to a financed purchase. Lets assume the local tax rate is 6.0%. Both have advantages and disadvantages. this spreadsheet presentation shows the financial analysis leading to the lease versus buy decision and pad will be professor of Finance at purdue university calumet in a leasing contract the lessee is the party wishing to borrow the equipment's as shown in this illustration the lessor is the lending party so the equipment will transfer from the lessor to the lessee for the lease II Once you have calculated the after-tax value of each financial alternative, you will typically find one solution to be more beneficial for you and your company. The primary difference between buying and leasing equipment is that with the former, you own the asset until you sell or dispose of it. Lease vs Buy Decision.  Buying needs 10-20% of immediate down payment. You have the option to take out a new lease once your existing lease expires, allowing you to get more modern Equipment. Term in months for your equipment loan.

Buying needs 10-20% of immediate down payment. You have the option to take out a new lease once your existing lease expires, allowing you to get more modern Equipment. Term in months for your equipment loan.  Maintenance. Leasing your essential equipment items is not only a convenient and easy solution to equipment acquisitions, it is also probably going to be the most effective way for you to successfully manage the expenses of a leasing agreement. For a $26,000 vehicle the tax for a purchase is $26,000 x .06 = $1560. Rising rates on equipment loans may make leasing a more attractive alternative to Having a well-designed lease versus buy analysis is fundamental to an efficient equipment leasing program. Compared to a loan arrangement to purchase the same equipment, a lease usually . Ownership and application of the equipment on your own terms. Each decision regarding equipment leasing or buying should be made carefully to best fit your companys situation and needs. When the lease contract ends, the lessee surrenders the leased property to the lessor. February 28, 2018. Leasing or buying of equipment affects business accounting needs, this includes tax implications, maintenance costs, and upfront costs. Use the following calculator to analyze the total financial impact of up-front fees, interest rates and residual value on the lease versus buy decision. Leasing allows you to pay less and get all the benefits of buying (most of). Lower Overall Costs. Opportunity for additional cash flow from selling the equipment at the end of use. Beyond simply weighing the overall costs of buying or leasing a piece of equipment, you also need to consider maintenance, tax deductions, flexibility and more. You may be able to extend the lease, stop the lease, or even purchase the home you are renting.Maintenance Record.Cost to Lease vs. Buying allows you to take ownership but at a hefty cost. Lease Calculator. Excavators: Excavators in the 15-to-20-ton range cost up to $200,000 brand-new.

Maintenance. Leasing your essential equipment items is not only a convenient and easy solution to equipment acquisitions, it is also probably going to be the most effective way for you to successfully manage the expenses of a leasing agreement. For a $26,000 vehicle the tax for a purchase is $26,000 x .06 = $1560. Rising rates on equipment loans may make leasing a more attractive alternative to Having a well-designed lease versus buy analysis is fundamental to an efficient equipment leasing program. Compared to a loan arrangement to purchase the same equipment, a lease usually . Ownership and application of the equipment on your own terms. Each decision regarding equipment leasing or buying should be made carefully to best fit your companys situation and needs. When the lease contract ends, the lessee surrenders the leased property to the lessor. February 28, 2018. Leasing or buying of equipment affects business accounting needs, this includes tax implications, maintenance costs, and upfront costs. Use the following calculator to analyze the total financial impact of up-front fees, interest rates and residual value on the lease versus buy decision. Leasing allows you to pay less and get all the benefits of buying (most of). Lower Overall Costs. Opportunity for additional cash flow from selling the equipment at the end of use. Beyond simply weighing the overall costs of buying or leasing a piece of equipment, you also need to consider maintenance, tax deductions, flexibility and more. You may be able to extend the lease, stop the lease, or even purchase the home you are renting.Maintenance Record.Cost to Lease vs. Buying allows you to take ownership but at a hefty cost. Lease Calculator. Excavators: Excavators in the 15-to-20-ton range cost up to $200,000 brand-new.  This note is designed for instructors, and provides them with a background for an introductory lecture on information technology (IT) leasing. Essentially, the lease vs. buy analysis is all about capital planning. Instead, leasing allows the agency to spread out its IT costs over the period of the lease and the equipments economic life. To help you select the financing method most beneficial to you, we first prepare a thorough lease vs. buy analysis, which takes into account a number of variables and compares, dollar for dollar, leasing and purchase scenarios for your company.

This note is designed for instructors, and provides them with a background for an introductory lecture on information technology (IT) leasing. Essentially, the lease vs. buy analysis is all about capital planning. Instead, leasing allows the agency to spread out its IT costs over the period of the lease and the equipments economic life. To help you select the financing method most beneficial to you, we first prepare a thorough lease vs. buy analysis, which takes into account a number of variables and compares, dollar for dollar, leasing and purchase scenarios for your company.  Another significant benefit of leasing IT equipment is that you can avoid the maintenance and repair expenditures of purchasing it altogether. Although the payments may seem attractive, it may not always be the best financial decision versus purchasing the equipment outright and financing it with a low interest loan. When its time to acquire equipment, the question whether to purchase, rent or lease must be answered in the best way possible for

Another significant benefit of leasing IT equipment is that you can avoid the maintenance and repair expenditures of purchasing it altogether. Although the payments may seem attractive, it may not always be the best financial decision versus purchasing the equipment outright and financing it with a low interest loan. When its time to acquire equipment, the question whether to purchase, rent or lease must be answered in the best way possible for

Leasing has recently emerged as a feasible, cost-effective alternative to purchasing equipment, particularly in the desktop and laptop areas. By comparing these amounts, you can determine which is the better value for you. A lease vs. buy analysis provides two crucial benefits: Helps to determine whether to lease or buy a specific piece or set of equipment. when evaluating a lease with a buyout option to a purchase. Lease vs. buy equipment analysis. What type of lease are you considering? The decision on whether to lease or purchase equipment must be made by: " Examining the IT management processes at the organization. Leasing vs buying is not an easy decision to make regardless of the asset involved. Any analysis is a result of the information you have provided. Typically this is 36, 48, 60 or 72 months. Compare results. Enter in terms of lease or loan. On the other hand, if you have modest tech needs and can comfortably use the same gear for longer than five years, it may The value of your currently owned vehicle credited towards the We calculate monthly payments and your total net cost. Lease vs. Buy analysis Ensure your business always makes the best economic decisions For all types of equipment leases Trucks, vans, autos, and other vehicles Forklifts and material handling equipment Laptops, servers, and data center equipment Office furniture and equipment There are advantages and disadvantages to both buying and leasing computers and IT equipment. Tax

Leasing has recently emerged as a feasible, cost-effective alternative to purchasing equipment, particularly in the desktop and laptop areas. By comparing these amounts, you can determine which is the better value for you. A lease vs. buy analysis provides two crucial benefits: Helps to determine whether to lease or buy a specific piece or set of equipment. when evaluating a lease with a buyout option to a purchase. Lease vs. buy equipment analysis. What type of lease are you considering? The decision on whether to lease or purchase equipment must be made by: " Examining the IT management processes at the organization. Leasing vs buying is not an easy decision to make regardless of the asset involved. Any analysis is a result of the information you have provided. Typically this is 36, 48, 60 or 72 months. Compare results. Enter in terms of lease or loan. On the other hand, if you have modest tech needs and can comfortably use the same gear for longer than five years, it may The value of your currently owned vehicle credited towards the We calculate monthly payments and your total net cost. Lease vs. Buy analysis Ensure your business always makes the best economic decisions For all types of equipment leases Trucks, vans, autos, and other vehicles Forklifts and material handling equipment Laptops, servers, and data center equipment Office furniture and equipment There are advantages and disadvantages to both buying and leasing computers and IT equipment. Tax  Although the payments may seem attractive, it may not always be the best financial decision versus purchasing the equipment outright and financing it with a low interest loan. A key component of this evaluation is the lease versus buy analysis. Easier to replace or sell at the owner's discretion compared with replacing leased equipment; Lease vs buy analysis under ASC 842, IFRS 16 and GASB 87. Calculate the net advantage to leasing (NAL) the restaurant equipment. The key to success is the structure of the analysis. Our lease vs buy calculator is a free Excel tool that can help you and your team make an informed choice as you weigh the risks of purchasing and leasing.

Although the payments may seem attractive, it may not always be the best financial decision versus purchasing the equipment outright and financing it with a low interest loan. A key component of this evaluation is the lease versus buy analysis. Easier to replace or sell at the owner's discretion compared with replacing leased equipment; Lease vs buy analysis under ASC 842, IFRS 16 and GASB 87. Calculate the net advantage to leasing (NAL) the restaurant equipment. The key to success is the structure of the analysis. Our lease vs buy calculator is a free Excel tool that can help you and your team make an informed choice as you weigh the risks of purchasing and leasing.  Use this calculator to find out! The anticipation of future business needs and assessing current business expenditures are some of the factors to be considered when leasing or buying an item. Advantages of Leasing . For example, if you need the asset for a long time, buying it makes sense because the equivalent annual cost of owning and managing it is less than leasing it. Equipment Financing Amidst the Rising Interest Rates and Inflation. Scissor lifts: Scissor lifts run about $22,000 brand-new. Saves Money: To begin, leasing IT equipment saves agencies money. Renting the same model costs around $399 every four weeks. If this is not the case, set this option according to your lease's terms.

Use this calculator to find out! The anticipation of future business needs and assessing current business expenditures are some of the factors to be considered when leasing or buying an item. Advantages of Leasing . For example, if you need the asset for a long time, buying it makes sense because the equivalent annual cost of owning and managing it is less than leasing it. Equipment Financing Amidst the Rising Interest Rates and Inflation. Scissor lifts: Scissor lifts run about $22,000 brand-new. Saves Money: To begin, leasing IT equipment saves agencies money. Renting the same model costs around $399 every four weeks. If this is not the case, set this option according to your lease's terms.  Pros and Cons of Leasing vs. Buying Equipment. On the one hand, buying involves higher monthly costs, but you own an assetyour vehiclein the end.

Pros and Cons of Leasing vs. Buying Equipment. On the one hand, buying involves higher monthly costs, but you own an assetyour vehiclein the end.  If your loan term is longer than your lease term, we compare the buy vs lease options to the time the lease expires, and then use your remaining loan term to calculator you outstanding loan balance. Leasing equipment works much like renting a car or house. A lease is essentially the renting of an asset for some specified period. eBook Lease vs. Buy Analysis Best practices for IT, fleet and equipment leasing programs Download eBook Benefits of equipment leasing: Cash flow Budget expansion Technology obsolescence Lower asset management Leasing as a strategic tool Corporate finance organizations should think about equipment finance and leasing as a strategic tool for the Renting runs $571 per day or $3,433 every four weeks. Forklifts: A 6,000-pound model costs around $13,000 new but rents for $1,640 every four weeks. It is assumed that the old equipment has no resale value whereas the new equipment would have a salvage value of $30,000 after 5 years. Helps to project the future all-in costs of leasing. FMV means you can buy the equipment at the lease's end for its fair-market value, which could be hundreds of dollars. With leasing, you eliminate the need for a large cash expenditure over buying equipment outright. The information provided here is to assist you in planning for your future. The choice between buying and leasing a car is often a tough call.

If your loan term is longer than your lease term, we compare the buy vs lease options to the time the lease expires, and then use your remaining loan term to calculator you outstanding loan balance. Leasing equipment works much like renting a car or house. A lease is essentially the renting of an asset for some specified period. eBook Lease vs. Buy Analysis Best practices for IT, fleet and equipment leasing programs Download eBook Benefits of equipment leasing: Cash flow Budget expansion Technology obsolescence Lower asset management Leasing as a strategic tool Corporate finance organizations should think about equipment finance and leasing as a strategic tool for the Renting runs $571 per day or $3,433 every four weeks. Forklifts: A 6,000-pound model costs around $13,000 new but rents for $1,640 every four weeks. It is assumed that the old equipment has no resale value whereas the new equipment would have a salvage value of $30,000 after 5 years. Helps to project the future all-in costs of leasing. FMV means you can buy the equipment at the lease's end for its fair-market value, which could be hundreds of dollars. With leasing, you eliminate the need for a large cash expenditure over buying equipment outright. The information provided here is to assist you in planning for your future. The choice between buying and leasing a car is often a tough call.

Plus you dont have pay repair costs if you return the item and lease a new one when its damaged. Some of the situations where we frequently see customers considering the differences between leasing and purchasing hardware include: Purchasing is more cost-efficient. 2) Year 0 in the analysis is counted as a full year for financial and

Plus you dont have pay repair costs if you return the item and lease a new one when its damaged. Some of the situations where we frequently see customers considering the differences between leasing and purchasing hardware include: Purchasing is more cost-efficient. 2) Year 0 in the analysis is counted as a full year for financial and

When equipment is purchased, the buyer owns 100 percent of the property and has complete control of it. While there are lease vs buy analysis Excel sheets, choosing one over the other is still no walk in the park. In brief, Operating Leases work similarly to a rental contract.

When equipment is purchased, the buyer owns 100 percent of the property and has complete control of it. While there are lease vs buy analysis Excel sheets, choosing one over the other is still no walk in the park. In brief, Operating Leases work similarly to a rental contract.

Among the advantages of leasing equipment: Lower up-front down-payment costs compared to purchasing; For tax purposes, lease payments are considered production expenses. Purchasing hardware is required if you have sensitive data.

Among the advantages of leasing equipment: Lower up-front down-payment costs compared to purchasing; For tax purposes, lease payments are considered production expenses. Purchasing hardware is required if you have sensitive data.  Leasing can meet short-term needs. In an organization with this type of process, you can figure out how many simple business/acquisition analysis are overlooked. A lease is a contractual arrangement whereby one party (i.e., the owner of an asset) grants the other party the right to use the asset in return for a periodic payment. In contrast, a $1 buyout option means the equipment is

Leasing can meet short-term needs. In an organization with this type of process, you can figure out how many simple business/acquisition analysis are overlooked. A lease is a contractual arrangement whereby one party (i.e., the owner of an asset) grants the other party the right to use the asset in return for a periodic payment. In contrast, a $1 buyout option means the equipment is  And so, all youre paying for is to use your equipment, rather than making more meaningful payments to own it (like buying offers you). The decision to lease or buy technology and other equipment is best made on a case-by-case basis, as every business is unique. Many factors play into your decision and it can be stressful deciding which is best for your particular business. Lets take a look at the pros and the cons of leasing vs buying equipment for your business. Since it is not always easy to determine every single equipment item your business Lease sales tax paid when - For this lease vs. buy analysis, the calculator assumes that you pay sales tax on the lease as an up-front lump sum. Once you have calculated the after-tax value of each financial alternative, you will typically find one solution to be more beneficial for you and your company. 5.

And so, all youre paying for is to use your equipment, rather than making more meaningful payments to own it (like buying offers you). The decision to lease or buy technology and other equipment is best made on a case-by-case basis, as every business is unique. Many factors play into your decision and it can be stressful deciding which is best for your particular business. Lets take a look at the pros and the cons of leasing vs buying equipment for your business. Since it is not always easy to determine every single equipment item your business Lease sales tax paid when - For this lease vs. buy analysis, the calculator assumes that you pay sales tax on the lease as an up-front lump sum. Once you have calculated the after-tax value of each financial alternative, you will typically find one solution to be more beneficial for you and your company. 5.  Lease vs buy equipment - A lease is a long term agreement to rent equipment, land, buildings, or any other asset. To decide the best way to fund equipment acquisitions, you need to perform a detailed lease versus buy analysis by comparing the cost to buy now against the future costs of leasing.

Lease vs buy equipment - A lease is a long term agreement to rent equipment, land, buildings, or any other asset. To decide the best way to fund equipment acquisitions, you need to perform a detailed lease versus buy analysis by comparing the cost to buy now against the future costs of leasing.

- Ashley Furniture Catalog 2021

- Us Open Wrestling 2022 Results

- Predator 420cc Engine Parts

- Epoxy Spray Paint For Wood

- Etude House My Lash Serum Eyebrows

- Best Leather Sandals For Women

- Closetmaid Stackable 2-door Storage Cabinet

- Best Womens Roller Skates

- Is Closet Evolution And Easy Track The Same

- Travel Essentials List During Covid

- Burgundy Platform Loafers

- Silver Filigree Earrings

- Extra Long Curtain Rods 200 Inches

- Bugaboo Fox Basket Install

- Lenovo Thinkpad X1 Yoga Gen 6 Specs

- What Is The Smallest Masonry Drill Bit

- Kombo Butter Hair Benefits

- Chemise Nightgown Pattern