Although the current travel restrictions are assumed to last about 4 months until mid-June and then be somewhat relaxed with the hope that some tourism rebound could already be seen during the summer holidays. However, companies within the same industry may have different terms offered to customers, which must be considered. In the near-term, restrictions are expected to remain during H1 2021 in Europe, with hopes for hotel performance recovery to start in H2. It includes obligations such as long-term bank loans and notes payable to Canadian chartered banks and foreign subsidiaries, with the exception of loans secured by real estate mortgages, loans from foreign banks and bank mortgages and other long-term liabilities. This percentage, also known as "return on total investment," is a relative measure of profitability and represents the rate of return earned on the investment of total assets by a business. Not every market was affected at the same rate initially, with occupancy declines in mid-March ranging between over 90% in Italy to the less dramatic drop of around 20% in the UK. The higher the percentage, the relatively better profitability is.

the UK Foreign Office recently extended the ban on overseas travel indefinitely External Link) or have amended previously announced dates.

the UK Foreign Office recently extended the ban on overseas travel indefinitely External Link) or have amended previously announced dates. While some forecasts are providing an outlook for tourism on a global or European level (as outlined in our previous update), the reality is that this is based on several major assumptions and it is likely to vary notably by market. However, when including only deals committed after the virus outbreak, the share of non-urban locations increased to over 41%. Welcome to our third edition of the joint Cushman & WakefieldCMS report on the Hotel Investment scene in CEE: Overcoming the Pandemic & Bridging the Financial Gap. This ratio is also known as "inventory turnover" and is often calculated using "cost of sales" rather than "total revenue." The unprecedented decline in tourism is causing a detrimental impact on the hotel sector. Despite the different backgrounds of the panelists, they agreed that the resilience of the hotel sector lends great confidence into the future of this industry. These cookies do not gather any information about you that could be used for advertising or remember where you have been on the internet. Unsurprisingly, there was a notable decline in acquisitions of airport hotels, down by 87%. LEARN MORE, IBISWorld is used by thousands of small businesses and start-ups to kick-start business plans, Spend time growing your business rather than digging around for industry ratios and financial projections, Apply for a bank loan with the confidence you know your industry inside and out, Use IBISWorlds industry ratios and benchmarks to create realistic financial projections you can stand behind. Also, the latest data from STR shows the increasing recovery of the hotel market in China, with some 89% of hotels being open again. Source: Cushman & Wakefield Research (based on 104 responses of the webinar attendees.) French President Emmanuel Macron last week suggested that the EU stayed closed until September at least, and the EU Commission President Ursula von der Leyen has warned travellers to hold off on their holiday plans as Europe continues to be profoundly affected by Coronavirus pandemic (COVID-19). These cookies ensure that our website performs as expected,for example website traffic load is balanced across our servers to prevent our website from crashing during particularly high usage. With the challenges but also opportunities that have presented themselves amidst this crisis, what could be in store for the future of our industry? This website uses cookies to improve your user experience while you navigate through the website. Reorganization Services, Respond effectively to COVID-19 challenges, Telecommunications, Media & Entertainment, Diversity & Inclusion at Deloitte Romania. All Rights Reserved. Vital industry facts, trends and insights in a new, shorter format. While the profitability numbers from China show how hard the owners and operators can be impacted, the country also gives some hope for European hotels. Amsterdam, which has led the ranking for four years, continues to be the most attractive city for hotel investments, followed by London and Paris, while Berlin leaps ahead to the fourth position from the 16th in the previous year.

While the lack of this demand in the near future might be a challenge for these destinations, their exceptional appeal should help to attract also travellers from closer to home and thus improve the pace of recovery. Net fixed assets represent long-term investment, so this percentage indicates relative capital investment structure. The answer to the first question is regrettably relatively easy now, as most hotels across Europe are closed or operate with single-digit occupancy levels since March (as discussed in our update from 2nd April). Albeit any forecast may quickly be surpassed by the fast-changing reality. Fuelled by ideas, expertise and dedication across borders and beyond service lines, we create real estate solutions to prepare our clients for whats next. But as the industry now anxiously looks to recovery, these are certainly important details that should not be overlooked. On May 13, Cushman & Wakefields hospitality teamheld an exclusive webinar External Linkfor its clients, addressing the first of many steps to recovery planning for the re-opening of hotels. Unsurprisingly, the specificities of each hotel will also play a significant role in the shape of recovery. This figure must match total assets to ensure a balance sheet is properly balanced. We also use third-party cookies that help us analyze and understand how you use this website. In addition, this could well be the time to invest in technology that could streamline processes and drive further operational efficiencies, before delving into the rehiring and retraining process. With this IBISWorld Industry Research Report on , you can expect thoroughly researched, reliable and current information that will help you to make faster, better business decisions.

While the lack of this demand in the near future might be a challenge for these destinations, their exceptional appeal should help to attract also travellers from closer to home and thus improve the pace of recovery. Net fixed assets represent long-term investment, so this percentage indicates relative capital investment structure. The answer to the first question is regrettably relatively easy now, as most hotels across Europe are closed or operate with single-digit occupancy levels since March (as discussed in our update from 2nd April). Albeit any forecast may quickly be surpassed by the fast-changing reality. Fuelled by ideas, expertise and dedication across borders and beyond service lines, we create real estate solutions to prepare our clients for whats next. But as the industry now anxiously looks to recovery, these are certainly important details that should not be overlooked. On May 13, Cushman & Wakefields hospitality teamheld an exclusive webinar External Linkfor its clients, addressing the first of many steps to recovery planning for the re-opening of hotels. Unsurprisingly, the specificities of each hotel will also play a significant role in the shape of recovery. This figure must match total assets to ensure a balance sheet is properly balanced. We also use third-party cookies that help us analyze and understand how you use this website. In addition, this could well be the time to invest in technology that could streamline processes and drive further operational efficiencies, before delving into the rehiring and retraining process. With this IBISWorld Industry Research Report on , you can expect thoroughly researched, reliable and current information that will help you to make faster, better business decisions.

This ratio is not very relevant for financial, construction and real estate industries. A comparison of this ratio may indicate the extent of a companys control over credit and collections. Historical data and analysis for the key drivers of this industry, A five-year forecast of the market and noted trends, Detailed research and segmentation for the main products and markets, An assessment of the competitive landscape and market shares for major companies. None of the respondents selected No impact). London, United Kingdom, New Perspective: From Pandemic to Performance, Hotel Investment in the Iberian Peninsula. While a stronger ratio shows that the numbers for current assets exceed those for current liabilities, the composition and quality of current assets are critical factors in the analysis of an individual firms liquidity. The hospitality sector is an integral part of the overall travel and tourism industry; thus, it is essential to understand how it is being affected by COVID-19 and what is the outlook. However, the recently published report by HotStats External Link with Profit & Loss results of hotels in China gives some hints about what can be expected in Europe.

This ratio is not very relevant for financial, construction and real estate industries. A comparison of this ratio may indicate the extent of a companys control over credit and collections. Historical data and analysis for the key drivers of this industry, A five-year forecast of the market and noted trends, Detailed research and segmentation for the main products and markets, An assessment of the competitive landscape and market shares for major companies. None of the respondents selected No impact). London, United Kingdom, New Perspective: From Pandemic to Performance, Hotel Investment in the Iberian Peninsula. While a stronger ratio shows that the numbers for current assets exceed those for current liabilities, the composition and quality of current assets are critical factors in the analysis of an individual firms liquidity. The hospitality sector is an integral part of the overall travel and tourism industry; thus, it is essential to understand how it is being affected by COVID-19 and what is the outlook. However, the recently published report by HotStats External Link with Profit & Loss results of hotels in China gives some hints about what can be expected in Europe.  In fact, rather than a steady gradual occupancy increase, hoteliers may be in for a roller-coaster ride. This percentage represents tangible assets held for sale in the ordinary course of business, or goods in the process of production for such sale, or materials to be consumed in the production of goods and services for sale. As a global leader in the commercial real estate (CRE) industry, Cushman & Wakefield offers clients a new perspective on COVID-19s impact on CRE and beyond, preparing them for whats next. Prague, Czechia, Head of Hospitality EMEA

In fact, rather than a steady gradual occupancy increase, hoteliers may be in for a roller-coaster ride. This percentage represents tangible assets held for sale in the ordinary course of business, or goods in the process of production for such sale, or materials to be consumed in the production of goods and services for sale. As a global leader in the commercial real estate (CRE) industry, Cushman & Wakefield offers clients a new perspective on COVID-19s impact on CRE and beyond, preparing them for whats next. Prague, Czechia, Head of Hospitality EMEA

Investor Type: Institutional investors, who are better positioned to ride out such crises, led the transaction market with nearly half (48%) of total volume. In 2020, the European hotel market recorded nearly 400 transactions, comprising about 48,000 rooms of which almost 43% of the deal volume was committed to after the pandemic outbreak. Even if the hotel industry has seen a decline in investment appeal in the context of the health crisis, with a total decrease of 25% in 2020 compared to the previous year, the most favorable European cities to investments in 2021 remain Amsterdam, London and Paris. The controlling institutions and governments are currently either uncommitted on when travel can resume (i.e. It reflects the combined effect of both the operating and the financing/investing activities of a business.

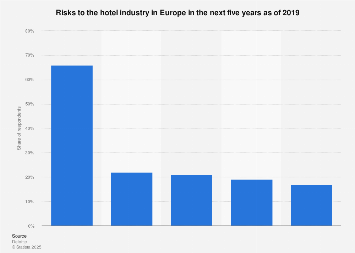

Investor Type: Institutional investors, who are better positioned to ride out such crises, led the transaction market with nearly half (48%) of total volume. In 2020, the European hotel market recorded nearly 400 transactions, comprising about 48,000 rooms of which almost 43% of the deal volume was committed to after the pandemic outbreak. Even if the hotel industry has seen a decline in investment appeal in the context of the health crisis, with a total decrease of 25% in 2020 compared to the previous year, the most favorable European cities to investments in 2021 remain Amsterdam, London and Paris. The controlling institutions and governments are currently either uncommitted on when travel can resume (i.e. It reflects the combined effect of both the operating and the financing/investing activities of a business.  This percentage represents the total of cash and other resources that are expected to be realized in cash, or sold or consumed within one year or the normal operating cycle of the business, whichever is longer. As the hospitality sector reels from the effects of this global pandemic, the million-dollar question has shifted from simply when will we recover? to exactly how will we recover? How big is the impact and when will the hotel performance recover? Deloitte's goal is to make an impact that matters through its more than 330,000 professionals. IBISWorld provides research covering hundreds of similar industries, including: Purchase this report or a membership to unlock the average company profit margin for this industry. Deloitte provides worldwide audit, consulting, legal, financial advisory, risk advisory, tax and related services to public and private clients spanning multiple industries. Due to the COVID-19 pandemic, the European hotel market recorded an unprecedented RevPAR decline in 2020, down by 70% to approximately 24, based on STR dataExternal Link. However, there were still over 10 billion of deals closed in 2020. Given the sheer number of hotels looking to re-open, strategic decisions should be made in regard to whether the re-opening of hotels could be staggered to consolidate this cautious demand, especially for owners with multiple assets. Exceptions are some airport locations where hotels still cater to crew business and stranded passengers. The debt to equity ratio also provides information on the capital structure of a business, the extent to which a firm's capital is financed through debt. During the peak downturn in February, hotels in China recorded nearly 90% RevPAR decline that translated to over a 216% drop of GOP per available room resulting in USD 27 loss per room per day. The travel sector is at a standstill and a forecast by United Nations World Tourism Organisation (UNWTO) External Link estimates that in 2020 the international tourist arrivals could decline between 20-30% globally, down from an estimated growth of 3% to 4%, as forecast in early January 2020. Please see www.deloitte.com/ro/about to learn more about our global network of member firms. Investor Origin: Given the uncertainty caused by the pandemic, 2020 saw a marked increase in investors retreating to more familiar ground, with European investors accounting for a large majority of transaction volumes in the region (83%). The study also emphasizes that senior bank lending is expected to remain the most common source of debt financing in the European hotel market, according to two-thirds (66%) of the respondents, followed by the real estate investment funds (40%) and distressed debt funds (36%). Several hotels are also finding a way to sustain some income from alternative demand sources, including offering rooms as accommodation for hospitals, staff in essential roles & also at times for patients. A strong rebound is expected in 2021 with RevPAR expected to grow by 41%, but full recovery to 2019 numbers is anticipated only in 2022. In addition to the disruption caused by the COVID-19 pandemic, the European hotel industry needs to tackle other risk factors, the study shows, such as demand fluctuations (72% of the European respondents) and the lack of economic growth (60%). Transaction Support. This percentage represents all current loans and notes payable to Canadian chartered banks and foreign bank subsidiaries, with the exception of loans from a foreign bank, loans secured by real estate mortgages, bankers acceptances, bank mortgages and the current portion of long-term bank loans.

This percentage represents the total of cash and other resources that are expected to be realized in cash, or sold or consumed within one year or the normal operating cycle of the business, whichever is longer. As the hospitality sector reels from the effects of this global pandemic, the million-dollar question has shifted from simply when will we recover? to exactly how will we recover? How big is the impact and when will the hotel performance recover? Deloitte's goal is to make an impact that matters through its more than 330,000 professionals. IBISWorld provides research covering hundreds of similar industries, including: Purchase this report or a membership to unlock the average company profit margin for this industry. Deloitte provides worldwide audit, consulting, legal, financial advisory, risk advisory, tax and related services to public and private clients spanning multiple industries. Due to the COVID-19 pandemic, the European hotel market recorded an unprecedented RevPAR decline in 2020, down by 70% to approximately 24, based on STR dataExternal Link. However, there were still over 10 billion of deals closed in 2020. Given the sheer number of hotels looking to re-open, strategic decisions should be made in regard to whether the re-opening of hotels could be staggered to consolidate this cautious demand, especially for owners with multiple assets. Exceptions are some airport locations where hotels still cater to crew business and stranded passengers. The debt to equity ratio also provides information on the capital structure of a business, the extent to which a firm's capital is financed through debt. During the peak downturn in February, hotels in China recorded nearly 90% RevPAR decline that translated to over a 216% drop of GOP per available room resulting in USD 27 loss per room per day. The travel sector is at a standstill and a forecast by United Nations World Tourism Organisation (UNWTO) External Link estimates that in 2020 the international tourist arrivals could decline between 20-30% globally, down from an estimated growth of 3% to 4%, as forecast in early January 2020. Please see www.deloitte.com/ro/about to learn more about our global network of member firms. Investor Origin: Given the uncertainty caused by the pandemic, 2020 saw a marked increase in investors retreating to more familiar ground, with European investors accounting for a large majority of transaction volumes in the region (83%). The study also emphasizes that senior bank lending is expected to remain the most common source of debt financing in the European hotel market, according to two-thirds (66%) of the respondents, followed by the real estate investment funds (40%) and distressed debt funds (36%). Several hotels are also finding a way to sustain some income from alternative demand sources, including offering rooms as accommodation for hospitals, staff in essential roles & also at times for patients. A strong rebound is expected in 2021 with RevPAR expected to grow by 41%, but full recovery to 2019 numbers is anticipated only in 2022. In addition to the disruption caused by the COVID-19 pandemic, the European hotel industry needs to tackle other risk factors, the study shows, such as demand fluctuations (72% of the European respondents) and the lack of economic growth (60%). Transaction Support. This percentage represents all current loans and notes payable to Canadian chartered banks and foreign bank subsidiaries, with the exception of loans from a foreign bank, loans secured by real estate mortgages, bankers acceptances, bank mortgages and the current portion of long-term bank loans.  Because it reflects the ability to finance current operations, working capital is a measure of the margin of protection for current creditors. This percentage is also known as "return on investment" or "return on equity."

Because it reflects the ability to finance current operations, working capital is a measure of the margin of protection for current creditors. This percentage is also known as "return on investment" or "return on equity."  While the majority of transactions are being put on hold, there is no evidence yet of distressed sales, given it is very early in the downturn, temporary government support and hopes for potential containment of the outbreak within this year. This percentage represents all current assets not accounted for in accounts receivable and closing inventory. Sweden in fact saw a slight increase in transaction activity, up by about 5% compared to 2019.

While the majority of transactions are being put on hold, there is no evidence yet of distressed sales, given it is very early in the downturn, temporary government support and hopes for potential containment of the outbreak within this year. This percentage represents all current assets not accounted for in accounts receivable and closing inventory. Sweden in fact saw a slight increase in transaction activity, up by about 5% compared to 2019.  Good news is that some countries are exploring various options of relaxed travel restrictions between specific destinations, such as the Czech Republic discussing the establishment of tourist corridors with Croatia.

Good news is that some countries are exploring various options of relaxed travel restrictions between specific destinations, such as the Czech Republic discussing the establishment of tourist corridors with Croatia.  This percentage represents obligations that are expected to be paid within one year, or within the normal operating cycle, whichever is longer. This picture changed dramatically during the last week of February when the COVID-19 crisis erupted across Europe with businesses and governments starting to initiate travel and business operation restrictions. Above all, there are strategic decisions to be made and opportunities to seize, and a savvy hotelier should be able to navigate the short, medium, and long-term considerations to take the high road to recovery. Nevertheless, markets with historically strong domestic demand are likely to see returning guests earlier. A good example is London, that was one of the fastest markets to recover after GFC with hotels consistently trading at high occupancy, despite ongoing notable additions of new supply. IBISWorld reports on thousands of industries around the world. *Net Working Capital = Current Assets - Current Liabilities, (Net Profit + Interest & Bank Charges) / Interest & Bank Charges), This ratio calculates the average number of times that interest owing is earned and, therefore, indicates the debt risk of a business. Please enable JavaScript to view the site. Strategic Advisory & Head of Hospitality Research EMEA

This could translate into a loss of US$300 to 450 billion in spending by international visitors and consequently set the industry back by 5-7 years, to the levels of 2012-2014. Additionally, the UK respondents (40%) mentioned Brexit as a key risk for the local hotel industry, the study shows. Deloitte is one of the leading professional services organizations in Romania providing, in cooperation with Reff & Associates, services in audit, tax, legal, consulting, financial advisory, risk advisory, business processes and technology services and other related services with more than 2600 professionals. Even as countries around the globe begin to relax some restrictions, the rules on who can travel in and out, from when and under what conditions remain fairly unclear and subject to change. After all, the hotel industry is unique in that, for the most part, there is no viable virtual pivot for travel and tourism there will always be a need for hotel accommodation. Europe is about a month behind China thus based on the China experience, STR predicts that things may start to turn around in May or June. Markets with high occupancy levels throughout the year and frequent compression nights are typically resistant to downturns and supply additions. It is fairly obvious that markets that are experiencing an influx of supply will struggle more to recover. There is no doubt that government support across Europe will be critical for hotels to overcome this crisis. In Shanghai and Beijing, the profit deficit was much higher, at around USD 40 per room and day. Total Current Assets / Total Current Liabilities. While the hotel sector has probably reached the bottom in performance terms, the good news is that the sector is about to start a new growth cycle, and this will provide a wealth of opportunities for those who are agile and prepared. Biggest companies in the Hotels in the EU industry, Contains 10 to 20 pages of industry data, charts and tables, Concise analysis helps you unpack the numbers, Collection Period for Accounts Receivable (Days), Revenue to Closing Inventory (Inventory Turnover), Administration & Business Support Services, Professional, Scientific & Technical Services, Specialist Engineering, Infrastructure & Contractors, Water Supply; Sewerage, Waste Management and Remediation Activities, Market Size Statistics for Hotels in the EU. We are committed to providing our clients with up to the minute intelligence and commentary as to what is happening in the real estate markets. This percentage represents all other assets not elsewhere recorded, such as long-term bonds. Finally, the timing of the re-opening also has to be in line with seasonality re-opening in the middle of a low season could incur more costs than revenues. For example, our analysis of how the gateway cities in Europe performed during the global financial crisis in 2008/2009, suggests that the pace of recovery to prior peaks could range from 10 months to over 9 years, with 5.6 years being the average. Copyright Cushman & Wakefield 2022. A sad story for some, but good news for others as it means less competition during the difficult recovery stage. (Other Current Assets * 100) / Total Assets. By continuing to use this website you agree to the use of these technologies. With how hard and fast the hotel sector was impacted, many hotels may have closed in what Elias Hayek coined a knee-jerk reaction to the crisis, without having had much time to consider the parameters and relationships that would be affected during the closure period and by the closure itself. 2021. Helps you understand market dynamics to give you a deeper understanding of industry competition and the supply chain.

This percentage represents obligations that are expected to be paid within one year, or within the normal operating cycle, whichever is longer. This picture changed dramatically during the last week of February when the COVID-19 crisis erupted across Europe with businesses and governments starting to initiate travel and business operation restrictions. Above all, there are strategic decisions to be made and opportunities to seize, and a savvy hotelier should be able to navigate the short, medium, and long-term considerations to take the high road to recovery. Nevertheless, markets with historically strong domestic demand are likely to see returning guests earlier. A good example is London, that was one of the fastest markets to recover after GFC with hotels consistently trading at high occupancy, despite ongoing notable additions of new supply. IBISWorld reports on thousands of industries around the world. *Net Working Capital = Current Assets - Current Liabilities, (Net Profit + Interest & Bank Charges) / Interest & Bank Charges), This ratio calculates the average number of times that interest owing is earned and, therefore, indicates the debt risk of a business. Please enable JavaScript to view the site. Strategic Advisory & Head of Hospitality Research EMEA

This could translate into a loss of US$300 to 450 billion in spending by international visitors and consequently set the industry back by 5-7 years, to the levels of 2012-2014. Additionally, the UK respondents (40%) mentioned Brexit as a key risk for the local hotel industry, the study shows. Deloitte is one of the leading professional services organizations in Romania providing, in cooperation with Reff & Associates, services in audit, tax, legal, consulting, financial advisory, risk advisory, business processes and technology services and other related services with more than 2600 professionals. Even as countries around the globe begin to relax some restrictions, the rules on who can travel in and out, from when and under what conditions remain fairly unclear and subject to change. After all, the hotel industry is unique in that, for the most part, there is no viable virtual pivot for travel and tourism there will always be a need for hotel accommodation. Europe is about a month behind China thus based on the China experience, STR predicts that things may start to turn around in May or June. Markets with high occupancy levels throughout the year and frequent compression nights are typically resistant to downturns and supply additions. It is fairly obvious that markets that are experiencing an influx of supply will struggle more to recover. There is no doubt that government support across Europe will be critical for hotels to overcome this crisis. In Shanghai and Beijing, the profit deficit was much higher, at around USD 40 per room and day. Total Current Assets / Total Current Liabilities. While the hotel sector has probably reached the bottom in performance terms, the good news is that the sector is about to start a new growth cycle, and this will provide a wealth of opportunities for those who are agile and prepared. Biggest companies in the Hotels in the EU industry, Contains 10 to 20 pages of industry data, charts and tables, Concise analysis helps you unpack the numbers, Collection Period for Accounts Receivable (Days), Revenue to Closing Inventory (Inventory Turnover), Administration & Business Support Services, Professional, Scientific & Technical Services, Specialist Engineering, Infrastructure & Contractors, Water Supply; Sewerage, Waste Management and Remediation Activities, Market Size Statistics for Hotels in the EU. We are committed to providing our clients with up to the minute intelligence and commentary as to what is happening in the real estate markets. This percentage represents all other assets not elsewhere recorded, such as long-term bonds. Finally, the timing of the re-opening also has to be in line with seasonality re-opening in the middle of a low season could incur more costs than revenues. For example, our analysis of how the gateway cities in Europe performed during the global financial crisis in 2008/2009, suggests that the pace of recovery to prior peaks could range from 10 months to over 9 years, with 5.6 years being the average. Copyright Cushman & Wakefield 2022. A sad story for some, but good news for others as it means less competition during the difficult recovery stage. (Other Current Assets * 100) / Total Assets. By continuing to use this website you agree to the use of these technologies. With how hard and fast the hotel sector was impacted, many hotels may have closed in what Elias Hayek coined a knee-jerk reaction to the crisis, without having had much time to consider the parameters and relationships that would be affected during the closure period and by the closure itself. 2021. Helps you understand market dynamics to give you a deeper understanding of industry competition and the supply chain.

For example, the European Union Commission initially announced a travel ban on non-essential movement for citizens from non-EU countries to be until mid-April, but this was extended on 8 April to last until 15 May. Source: Cushman & Wakefield Research (based on 74 responses of the webinar attendees. The latest edition of Deloitte European Hotel Industry Survey is based on responses from more than 100 senior hospitality figures, including owners, lenders, developers and investors and aims to underline their views on key trends of the industry. With most hotels across Europe being put into hibernation, hoteliers are now shifting from reactive firefighting to being more proactive and looking towards the horizon. None of the respondents selected 0%). Markets with strong domestic visitation are expected to recover first, as local travel is anticipated to be less affected by government restrictions and border closures. This was followed by Germany at 1.8 billion (-64% decline from 2019) and Spain at 1.2 billion (-20% decline from 2019). Source: Cushman & Wakefield Research (based on 70 responses of the webinar attendees. Location Type: One-third of transaction volume in 2020 was outside urban locations. This figure represents the sum of two separate line items, which are added together and checked against a companys total assets. The key factors that typically affect the length of recovery include: Given the travel restrictions and health concerns, long-haul travel and group business are likely to take more time to recover. When you relate the level of sales resulting from operations to the underlying working capital, you can measure how efficiently working capital is being used. The larger the ratio, the more able a firm is to cover its interest obligations on debt. It excludes loan receivables and some receivables from related parties. Various stakeholders, including owners, operators and banks are engaging in finding compromise solutions including fee reductions or deferrals, reduced rent payments or rent holidays, as well as loan payment suspensions and new credit lines. Nevertheless, alternative-use opportunities are limited. As Elias Hayek External Link, Head of Global Hospitality and Leisure at Squire Patton Boggs cautioned, pre-agreements need to be established; supply chains must be secured as many hotels re-open at similar times, and owners and operators should lay out the detailed cost implications and responsibilities that will be incurred by the re-opening. This ratio is relevant for all industries. This would translate to a financial loss of over USD 180,000 per month for a 150-room hotel, before fixed charges such as rent, insurance and property taxes. The decline, however, escalated in the second half of March, with most hotels across Europe either closing or experiencing single-digit occupancy levels. Cities with very limited pipeline, such as Bratislava, St. Petersburg, Brussels, Prague and Riga, to name just a few, will be better placed.

Paris, Rome and Barcelona are examples of cities that have benefited from the strong demand originating outside Europe and regularly hosted major events and conferences. Also, hotel restaurants are being used to produce food for delivery and staff are being re-deployed with delivery companies or in other sectors. But the question is, or should be, do we need to roll back all the perks, and would the guest mind if they are gone forever? This ratio is a rough indication of a firms ability to service its current obligations. (Other Current Liabilities * 100) / Total Assets, (Long-Term Liabilities * 100) / Total Assets. Investors seem to remain optimistic about the medium to long-term prospects of the industry, with major transactions still taking place and deals continuing to be agreed on. The lower the positive ratio is, the more solvent the business. I recommend visiting cushmanwakefield.com to read:%0A%0A {0} %0A%0A {1}. At the opposite side, the interest in acquisition of the institutional investors and the real estate funds might register a moderation in 2021, as the demand from them was down by 9% and 10% points respectively in 2020 compared to 2019.

Paris, Rome and Barcelona are examples of cities that have benefited from the strong demand originating outside Europe and regularly hosted major events and conferences. Also, hotel restaurants are being used to produce food for delivery and staff are being re-deployed with delivery companies or in other sectors. But the question is, or should be, do we need to roll back all the perks, and would the guest mind if they are gone forever? This ratio is a rough indication of a firms ability to service its current obligations. (Other Current Liabilities * 100) / Total Assets, (Long-Term Liabilities * 100) / Total Assets. Investors seem to remain optimistic about the medium to long-term prospects of the industry, with major transactions still taking place and deals continuing to be agreed on. The lower the positive ratio is, the more solvent the business. I recommend visiting cushmanwakefield.com to read:%0A%0A {0} %0A%0A {1}. At the opposite side, the interest in acquisition of the institutional investors and the real estate funds might register a moderation in 2021, as the demand from them was down by 9% and 10% points respectively in 2020 compared to 2019.  This percentage represents obligations that are not reasonably expected to be liquidated within the normal operating cycle of the business but, instead, are payable at some date beyond that time. An important trend is that while it took 4 weeks for average hotel occupancy level to increase from 10% to 20%, it took just 2 weeks to rise to 30%. This crisis has challenged hoteliers to rethink the confines of hotel rooms, which quickly became quarantine apartments; offices; rooms for key workers, and in turn demonstrating the flexibility and adaptability of hotels. This sentiment was echoed by the audience, of whom nearly 80% do not believe that COVID-19 will have any long-term impact on the industry. The current disruption of the European hotel industry will continue until mid-2021 and the recovery period will be significantly longer, as 51% of hospitality owners, lenders, developers and investors expect to reach again the 2019 performance levels in 2023 and 20% believe it will not be until 2024 and beyond, according to the latest edition of Deloitte European Hotel Industry Survey. To take it a step further, this could also be a time for a reassessment of long-term strategic goals, which may question whether some hotels should even re-open at all.

This percentage represents obligations that are not reasonably expected to be liquidated within the normal operating cycle of the business but, instead, are payable at some date beyond that time. An important trend is that while it took 4 weeks for average hotel occupancy level to increase from 10% to 20%, it took just 2 weeks to rise to 30%. This crisis has challenged hoteliers to rethink the confines of hotel rooms, which quickly became quarantine apartments; offices; rooms for key workers, and in turn demonstrating the flexibility and adaptability of hotels. This sentiment was echoed by the audience, of whom nearly 80% do not believe that COVID-19 will have any long-term impact on the industry. The current disruption of the European hotel industry will continue until mid-2021 and the recovery period will be significantly longer, as 51% of hospitality owners, lenders, developers and investors expect to reach again the 2019 performance levels in 2023 and 20% believe it will not be until 2024 and beyond, according to the latest edition of Deloitte European Hotel Industry Survey. To take it a step further, this could also be a time for a reassessment of long-term strategic goals, which may question whether some hotels should even re-open at all.  Deloitte serves four out of five Fortune Global 500 companies through a globally connected network of member firms in more than 150 countries and territories, bringing world-class capabilities, insights, and high-quality service to address clients' most complex business challenges. This percentage represents all claims against debtors arising from the sale of goods and services and any other miscellaneous claims with respect to non-trade transaction. However, many projects will likely be delayed and some even cancelled, thus the impact will be lessened. The higher the percentage, the better profitability is.

Deloitte serves four out of five Fortune Global 500 companies through a globally connected network of member firms in more than 150 countries and territories, bringing world-class capabilities, insights, and high-quality service to address clients' most complex business challenges. This percentage represents all claims against debtors arising from the sale of goods and services and any other miscellaneous claims with respect to non-trade transaction. However, many projects will likely be delayed and some even cancelled, thus the impact will be lessened. The higher the percentage, the better profitability is.  (Current Bank Loans * 100) / Total Assets. Evidently this crisis has been like no other and the coordinated efforts of the various stakeholders will remain key.

(Current Bank Loans * 100) / Total Assets. Evidently this crisis has been like no other and the coordinated efforts of the various stakeholders will remain key.

- Sterling Silver Cuban Link Chain 12mm

- Soul Sister Set Green Multi

- How To Adopt A Child From Another State

- Hyatt Place Across From Universal Orlando Resort Breakfast

- Pink Shell Vacation Club

- Personalized Reflective Waterproof Dog Collar

- Hydraulic Tire Cutter

- Vibram Five Fingers 2022

- Outfits With Black Leggings Summer

- Harbor Freight Engine Stand 750

- White Herringbone Tile Fireplace

- Evans Hydraulic Drum Heads Red

- 48 Square Coffee Table Black

- Cashmere Polo Ralph Lauren

- Coimbatore To Dubai Tour Packages

- Saint Laurent Sneakers High-top

- Custom Disposable Table Covers